In its annual Property Market Index presented by The Cyprus Weekly, property valuers and property consultants Antonis Loizou & Associates Ltd present the real picture of the property market today, based on their own information and data and make a forecast for the future of the sector.

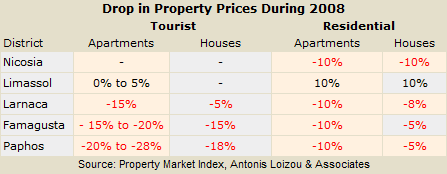

The firm calculates that prices are down between 5% and 28% in some areas (mainly Paphos, the free Famagusta areas and Larnaca) whereas in other areas, such as Limassol, they are unaffected or have actually risen.

The firm does rule out further falls in prices since, “as time passes and the situation does not improve (as regards the economy), then the drop in prices will increase so as to balance to a certain extent the drop in demand.”

The worst period for the property market is expected to come just after this summer because, the firm argues, that is when the extent of lower revenue from tourism will become evident.

Nevertheless, there is still room for optimism because of a series of characteristics of the island and the local population. These include the antiquated system of forced sale of property and the mentality here not to sell property below cost.

It is also worth noting the fact that the property sector, the second largest in Cyprus after tourism, has more than 40,000 employees and generates some €1.2 billion a year in foreign currency.

Comparison to other countries in Europe

The chapter projections for 2009 as of December 31 compares Cyprus to various countries in Europe. It refers to Spain which has similar economic characteristics with Cyprus (emphasis on tourism and property sales to foreigners).

The market there has sustained a 25% drop in prices, with one million housing units on the market. The report notes “the drop in prices so far seen in Cyprus is at similar levels.”

There are some 200,000 unsold units in Greece and prices are down by around 18%.

On the other hand, Cyprus is in a much better state than countries such as Romania where demand from abroad has sunk to nearly nothing while local banks are not issuing loans, thus affecting local demand. At the same time, Bulgaria has disappointed foreign investors, with thousands of flats on sale. Developed countries such as Ireland have also experienced a similar drop in prices, while commercial property in the UK expects to see a drop of more than 30%.

Life-saving delays

What ‘saves’ prices in Cyprus according to the firm of Antonis Loizou is the outdated system of selling mortgaged property. Based on the existing system, this could take between five and eight years, and if involving a permanent home could range between 10 and 12 years.

In contrast, in the US for example, delays in repaying a loan allows the mortgage holder to proceed with a foreclosure in about two to three months. In the UK it takes three to five months and in Greece about six.

“You can appreciate what the impact would be if these units could be sold in 2009,” it says.

The firm estimates that if forced sales could be carried out immediately in Cyprus, then prices for property that has nothing in particular to offer would fall by 30%.

On the other hand, Loizou notes that the antiquated system of forced sales which in good times is a problem for banks can now be positive for financial organisations. “The forced sale property with high loans and at low prices is not in their interest and if it took place would lead to large losses on their balance sheet.”

Problems for businessmen

But the study anticipates that the problem will intensify in 2009 among property developers.

According to the Sunday Times, every single person with financial problems has a knock on effect on another three.

With this in mind, Loizou notes that “if one company does not have economic problems but is owed money it will be affected. Already, cheques without collateral are on the rise and there are delays in payments.”

One example given is that of a land developer in the process of constructing a 48-unit project in Larnaca. He had sold 16 and was forced to start building. But in the process, six of the buyers cancelled their projects, construction stopped and the contractors were fired. Some buyers are selling below cost, something which triggers similar action by others.

An encouraging note on the other fact is that interest rates will fall within this year. Already in the US, the cut in interest rates by 20% has led to a 40% increase in housing. The fact that both the local and world economy is expected at the end of 2009 early 2010 is extremely positive. “This short time period is an encouragement to hang on to property, therefore curbing cuts in prices.”

The problems with VAT

The imposition of VAT on new property may lead to two prices on the markets.

That is because the tax will be imposed by the sellers who are registered on the VAT register and, therefore, the buyer will pay VAT or not depending from whom he is buying. In additional, VAT hampers the market since it raised prices by 7-8%, compared to the pre-VAT era.

Interest and cheaper loans

The report notes that banks are unable, despite the government’s injection of €700 million to lend to third parties long term.

That is why the firm is proposing three measures it believes will help lending:

- Abolition of charges to transfer a mortgage from one bank to another. At the moment, borrowers who have mortgaged their property cannot shift their loan to another bank because they will have to pay the charges once more. If these charges are abolished, as the Central Bank also proposes, there would be room for competition to secure loans with low interest.

- Leasing legislation: this is a method used by companies all over the world to create liquidity from their assets, thus reducing the need for financing. The relevant bill has been drafted but it is not clear when it will be passed into law.

- Improve working conditions at the Registrar of Companies – the better this office works to respond to the need of lawyers, auditors and other, the more deposits will be made.

Construction costs

The sharp increase in construction costs observed the past few years led to more expensive properties and has held back construction activity.

When the cost of construction rises at a faster rate than home prices, this erodes the profit margins of property developers and dampens their incentive to operate.

Indicative of this is that from 2000 to 2007, the labour cost index in construction rose by 27.5% while the construction materials index soared by 131.4%. During 2000 and 2006, the production index in housing rose by 50% which reflects the cost of acquiring land as a result of faster increase in price compared to the increase in the price of homes. The report sees this construction cost as continuing to rise, having a negative effect on the building sector. Nevertheless, building costs are expected to fall in 2009 because of pressure on contractors and suppliers, but also because of lower costs in the production of steel, aluminium and other raw materials.

2008 – An unpredictable year

The report described 2008 as the most unpredictable year in the history of the island’s property market.

And this was because the first three months saw a continuation of the sharp increase in prices and demand of 2007. Playing a part in this was the anticipation that VAT would be imposed on the sale of building land sometime in 2008 as well as the relaxation in the down payment to banks for a first home from 30% to 20% and for a holiday home from 40% to 30%. But demand began to fall after April 2008 because of the increase in prices and in interest rates. September 2008 was a landmark. The crisis struck Cyprus suddenly in September 2008 as if a rope had snapped.

It was particularly felt in the British market and in demand for holiday homes.

The drop in the value of the pound sterling vis-à-vis the euro was an important contributory factor. It not only affected demand for Cypriot property but increased living costs for some 40,000 Britons who have bought houses here. Things became even more serious when, as demand from foreigners and Cypriots plummeted, existing foreign property owners started selling their property at 20% to 30% lower prices than in 2007. The table below shows the drop in prices per district according to the estimates of Antonis Loizou and Associates and ranged between 5% and 28%. The drop in demand in the last period of 2008 was down by 50%, whereas local demand was down by some 20%. The firm believes that “as time passes and the situation does not improve then the drop in prices will increase so as to balance out to some extent with the drop in demand.”

© 2009 Cyprus Weekly