Last Friday the Chairman of the Cyprus Land and Building Developers Association, Lakis Tofarides, blamed high property prices on the cost of land which has rocketed over the last ten years and which now accounts for 40% – 50% of a property’s overall cost.

But Dr Michalis Sarris, the former Finance Minister, had a different opinion and suggested that the banks had helped to sustain inflated prices. “Some people would argue that over the last few years, there was an explosion in property prices connected with the profitability of developing. Prices have not been affected (currently) because banks have chosen not to press developers to repay their loans – they have extended more loans to allow the original ones to be paid. So the developers are now saying: why should I reduce my price, if I’m not forced to sell?” he said.

But regardless of who or what has caused the price of property to rise to today’s levels, the question remains whether or not property in Cyprus is overpriced.

How to tell if property is overpriced

It is quite straightforward. Any asset, such as a property, has a ‘return’; i.e. what you make for holding the asset. For example, if you put your money into an instant access savings account, you will receive a ‘return’ on your money – perhaps 3% per annum.

Traditionally, investments in property provide a ‘return’ in 2 ways:

- Capital appreciation (property price growth as shown by a price index)

- Rental income (if you own a property, you could rent it out).

It is difficult to create a simple formula that takes both of these elements into account individually. So they are usually combined to give an easy way of comparing the required sale price of a house against its ‘true worth‘. It is a simple calculation:

- If the annual rental income you can expect achieve from a property is around 6% or more of its price, then it is a ‘good’ investment. And the higher its annual rental income is compared to its price, the better an investment it becomes.

- Conversely, if the annual rental income you can expect achieve from a property is less than 5% of its price, then it is a ‘poor’ investment. And the lower its annual rental income is compared to its price, the poorer an investment it becomes.

A property is ‘fairly priced’, for both the buyer and seller, when its annual rental income is between 5% and 8% of its price. This percentage return is known as its ‘Yield’ – and it is an industry standard formula for assessing the value of property.

Is property in Cyprus overpriced?

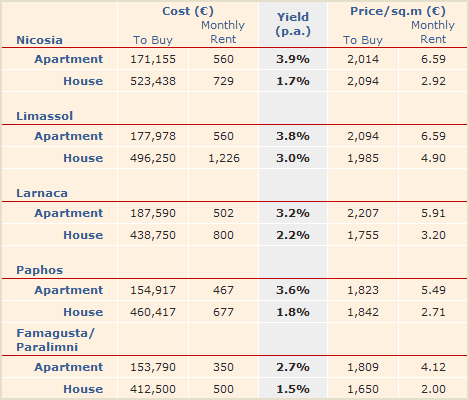

Using the RICS Cyprus Property Price Index published last Friday, I have calculated the ‘Yields’ of apartments and houses in Nicosia, Limassol, Larnaca, Paphos and Famagusta/Paralimni using the industry standard formula; the results are presented below.

As you can see, ‘Yields’ are extremely low indicating that property is overvalued; in some cases by more than three times what would be considered a ‘fair price’.

So yes, Cyprus property is overpriced using an industry standard ‘fair price’ model.

(Note that the RICS Cyprus Property Price index is based on residential properties located in residential areas. For more information please see the report prepared by Reading University).

The Irish experience

THE property bubble in Ireland built up between 2000 and 2007, as with many other western European countries, with a combination of increased speculative construction and rapidly rising prices.

Prices stabilised in 2007 and the bubble burst in 2008. By the first quarter of 2009, house prices had fallen by 23% compared with the second quarter of 2007, and the number of housing loans approved fell by 73%. The fall in domestic and commercial property prices contributed to the Irish banking crisis.

Last year, the Irish Government established the National Asset Management Agency (NAMA) in an effort to resolve the situation. NAMA will buy all of the land and property development loans off the six Irish banks covered by the State guarantee. This means the total potential value of the loans which will be taken on by NAMA will be between €80 billion and €90 billion. By taking problem property loans off the hands of the banks, the Irish Government hopes to put those institutions in a position where they can resume lending.

According to NAMA, spiralling property prices arose from:

- Massive growth in property-related lending 2004-2007.

- Insufficient attention within banks or within overall banking sector to basic risk management principles such as stress-testing.

- Insufficient attention to key issue of supply/demand.

- No rigorous analysis of whether scale of the rise in property prices could be justified by economic fundamentals.

- Enormous scale of lending to individuals who had little or no supporting corporate infrastructure or access to capital markets.

- Poor quality of credit appraisal.

- Over reliance on wholesale money markets.

- Failures of governance on the part of lending institutions’ Boards.

- Regulatory failures.

Is Cyprus heading in a similar direction?

I feel that your calculations to find the current yields for both bought and rented property ‘using the RICS Cyprus Property Price Index published last Friday’ as you state are basically flawed as a result of that source.

If you read the RICS report notes in detail, it lists the various areas within each town district that were targeted for the creation of the statistics and they are almost all for existing properties in either rather old areas, run down, down market parts of the main town or too far from anywhere significant to be acceptable for the foreign investor market. As is always the case with statistics, the resulting ‘averages’ are low and far different figures for the residential categories would have been obtained if the report were based on popular investment areas, whether for existing property or off-plan sales.

Nor does the report take into account any cost of the land built on or the added-value items that make up part of the cost of brand new projects.

Whilst the resulting report gives excellent information for the domestic market, it is entirely unsuitable for use by the ex-patriot buyer but it will, of course, be used widely in the UK, for example, as ‘proof’ that sellers are asking for too much money.

Yes, properties are overpriced in today’s financial market, but not as badly as this new RICS report suggests.

The problem as I see it is that too many developers had come into the market attracted by the profits to be made in building despite the fact that as stated building material costs have fallen 10%. In the U.K it is widely known and from insurance point of view, that 80% of a property’s value is in actual fact the land. Therefore land prices have got a way to go.

The fat is being made by the builders and developers and for that reason I am of the opinion that land prices are still cheap in comparison and that the adjustment is needed from a building cost perspective which thankfully should be the case now with many stuck with property they cannot off load.

I own land in Limassol, Zygi and Avgorou and the prices I was quoted to build in Zygi for effectively plasterboard partitions beggared belief and took to be a clear insult to my intelligence and walked away thank god 18 months ago.

In short buy land as it is still undervalued.

There is only one price relevant to a potential buyer/investor and that is the current market price.

The asking price is meaningless if actual transactions are occurring at a 50% discount.

House sales occur in an open market under the principles of willing buyer-willing seller and supply and demand.

One cannot just project a desired sales price based on a desired number as would appear to be the case in Cyprus at present.

The data I need in order to make an objective decision is a CMA (current market analysis) of the particular area I am wishing to purchase in. This should include actual house sales for the past year or two as recorded in the deeds office, size of plot, square meterage of dwelling, number of beds/bathrooms, etc, etc.

Not only is this info useful for the purchaser but it should also be used for the seller to arrive at a market related asking price. One cannot cherry-pick an asking price without taking into account current transactions as they are occurring at any particular time in any particular market.

Am I to assume that due to the title deeds fiasco, data on actual sales transactions is difficult to acquire and we are thus forced to make do with an estimated value?

Are house prices in Cyprus too high or are rental charges too low? Comparatively low rental charges obviously result in low yields and could make house prices appear too high.

When we came to live in Cyprus in 2004 we were going to buy. However, even then we considered that prices were too high and decided to rent – and have done so ever since. Last years rental yield (€10,000 pa) for our landlord has been 1.7% as the house is now on the market for (an unrealistic) €600,000. If a more realistic yield of 3.0% had been applied to the rent last year the house would be worth (a more realistic) €333,333. So, has the rent been too low or is the house price too high? It could be argued that the landlord will need to reduce his price by over €200,000 to sell it in the current climate.

We’ve spent around €50,000 on renting the house over the years; so we’ve given our Landlord €50,000 and he’s possibly looking at “losing” over €200,000!! That’s a bargain in my view as we could have also lost a lot of money if we had bought in the first place and were now selling.

The moral is in Cyprus – rent, don’t buy!

I believe that RICS and others should change the way they collect their data. The prices for apartments or houses are dependant on many parameters such as location, size of plot, build quality and even to small details such as facilities on the complex/project. Then they should also consider the weight they give to each attribute. They also have to see the population of the sales i.e what is selling and in what location of the city/district. Once these are in line then we can have a correct and representative median price.

I recon the prices in the index in areas such as Larnaca, Famagusta and Paphos are at least €20,000 higher than what they actually are.

The global economy is still very fragile and the property market worldwide is weak. Holiday destination properties such as those in Cyprus are likely to suffer.

Thanks for a researched and informative magazine.

Mr Tofarides say that property prices are high because the cost of land now accounts for 40% – 50% of a property’s overall cost.

This might be true now but in my 11 years of visiting Cyprus I have seen plots of land owned by developers still waiting to be developed. So the original cost of the land would have been very much less.

Therefore I think one of the main reasons that property prices are high is greed.

You pose a question at the end of your excellent article on overpriced property in Cyprus.

I would argue that Cyprus is already in a similar position to that experienced in Ireland.

There are now a large number of empty properties on new build developments, which I’m afraid developers will be unable to sell unless they reduce their prices by at least 25-30%.

In the current global economic climate developers in Cyprus must wake up to the fact that they can no longer rely on overinflated, unsustainable annual increases in property prices.

The island has been overdeveloped on a massive scale in the last few years.

The property bubble has well and truly burst in Cyprus and developers need to realise this.