ACCORDING to the first results of the new quarterly Cyprus Property Price Index (PPI), launched by the Royal Institution of Chartered Surveyors (RICS) Cyprus two weeks ago, low yields – the annual rental income from a property compared to its market value – strongly suggest that the market is overvalued.

Professor Patrick McAllister of the School of Real Estate and Planning at the University of Reading (UK), who was one of two academics commissioned by RICS Cyprus to develop the methodology underpinning the PPI, said at the index’s launch:

“What is striking is that yields on commercial property are quite low by European standards, but also hugely variable, even within Cyprus.

“Yields on residential property, for example 1.7% in Nicosia, are also extremely low. These incredibly low yields suggest that people pay over fifty times the rent [to purchase] a property. That would be a strong signal of a market being overvalued.”

Yield is just one of many tools that can be used to provide a snapshot of the strength of a property market at a given moment. If a property is valued at €100,000 and its rental income per year comes to €5,000, then the yield on that property is five per cent.

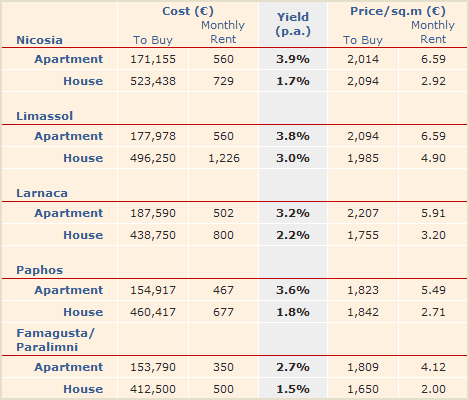

The results for the first quarterly RICS PPI gave an average unit price of €523,438 for a medium-quality three-bedroom, semi-detached, 250sqm house with a garden in Nicosia. An average monthly rent of €729 for such a house would give a yield of just under 1.7%, in other words one would have to pay around fifty times the annual rental income to buy it.

On the other hand, the average unit price of €171,155 for a medium-quality two-bedroom, 85sqm apartment in Nicosia would give a yield of 3.9%, based on an average monthly rent of €560. This is much closer to the normal EU range of 4%-7% yield, suggesting that it is mid-range houses that are over-valued rather than all residential property.

Costas Apostolides, an economist working with consultancy firm EMS, told the Mail: “My view is that properties are not overvalued.” He said that, although yields are typically very low in Cyprus, factors particular to the Cyprus market have historically constrained supply and so are the main reason behind the steady rise in property prices.

“With the exception of the time periods of the 1963-1964 inter-communal conflict, 1974 and 1991 (the first Gulf War), values have been steady, mainly gaining, in Cyprus,” Apostolides said.

One of the main reasons for this, he added, was a very high foreign demand for properties in Cyprus, due to its price competitiveness relative to other comparable locations within the EU, shored up over time by favourable exchange rates. Another major factor has been the very high tax on land, which continues to restrict supply by discouraging people from selling easily, thus distorting the market.

Cyprus Land & Building Developers Association President Lakis Tofarides said that a person in Cyprus can expect to pay 10 or 11 times the average annual salary to buy a property, compared to four times the average annual salary in the UK.

Tofarides said that this “affordability” gap is due to the fact that financial contributions by parents and relatives towards purchases by younger first-time buyers are common in Cyprus, and this family network support has fed price inflation in the property market.

So an alternative explanation for the low yield on houses – especially when compared to apartments – could be that this is simply the result of the limit to what people can afford to pay in rent on a regular independent basis, in other words without the benefit of the kind of financial support one might receive from family members as a one-off when buying a house.

Former Finance Minister Michalis Sarris, who spoke at the launch of the RICS PPI, said that the banks had also helped to stoke up the property market, first of all by lending 100% or 110% of property valuations on the basis that their loan portfolios were secure in a rising market.

He also suggested that the banks are now helping to sustain inflated prices: “Some people would argue that over the last few years, there was an explosion in property prices connected with the profitability of developing.

“Prices have not been affected (currently) because banks have chosen not to press developers to repay their loans – they have extended more loans to allow the original ones to be paid. So the developers are now saying: why should I reduce my price, if I’m not forced to sell?”

However, property indexes cannot be regarded as an absolute measure. “Measurement is one thing, interpretation is quite another,” McAllister said. The result is that different indexes can produce “conflicting messages” about what is happening in the market.

The RICS PPI is not based on actual sale prices of properties in specific areas, but on three valuations of sample properties carried out by surveyors in various areas of five urban centres in the island’s government-controlled area. Thus, for the first quarter of 2010 it has recorded what can only be described as the anticipated spread of property prices across major urban area.

“A true index can only be based on transaction prices, otherwise it is just an opinion poll, albeit an experts’ opinion poll,” said another economist who preferred to remain anonymous.

I consider the RICS price index as correct as far as the apartments are concerned. Houses prices though are well below the price set by the price index and this can be verified very easily just by looking in the newspapers having advertisements for properties on sale.

House prices per sq metre are far below prices for apartments.

Thanks.

If a house in the UK can be purchased for about 4 X the annual salary, that means a house in Cornwall here would be around £68,000 !!! I don`t think so. A two bed house terraced will set you back around £120,000 to £130,000, that means an average wage of £30 to £32.5 thousand per annum, extremely optimistic as most people especially the young are earning £12 to £14 K ask anyone at Trago Mills.

I’ve seen many houses in Nicosia in the last 2 years and can assure expertly, that there are NO 3-bedroom semi-detached houses in Nicosia in excess of €500,000.

For this money you can buy a 4-bedroom detached house in one the most expensive areas (Archangelos or Makedonitissa). And even then €500,000 will be seller’s dream. (€171,000 for a 2-bedroom flat, though, is a very accurate estimate. Rental estimates are accurate for both houses and flats).

“A true index can only be based on transaction prices, otherwise it is just an opinion poll, albeit an experts’ opinion poll,†said another economist who preferred to remain anonymous.”

So, after all the hype, we still don’t have a reliable property-price index!

If the prices stated in the index bore some resemblance to real life, then yields would be more sensible. Surely the people who composed the price index can see that in this economic climate, the prices they state are ridiculous.