FIGURES released by the Land Registry on Wednesday show that property sales fell for the fourth consecutive month compared to last year, heightening fears of a much longer recession in the Island’s property market than was anticipated earlier in the year.

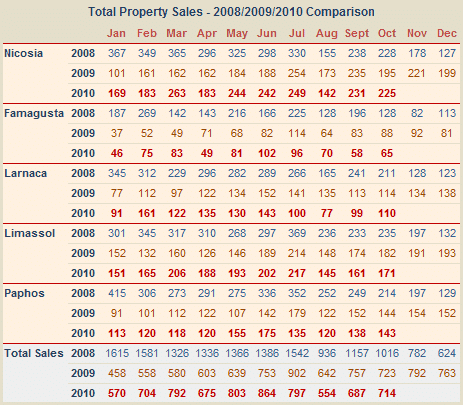

According to the Land Registry figures, the number of contracts of sale deposited at Land Registries throughout Cyprus in October was 714 compared to 687 in September and 723 in October 2009.

Last month, sales fell in all towns with the exception of Nicosia, which recorded an increase of 15.4%. In Famagusta, sales were down by 26% compared to last year, in Limassol they were down 6%, in Larnaca sales were down 4%, while in Paphos they were down 1%.

During the first half of the year, analysts were hopeful of a rapid recovery in the property market as sales had increased by 23%. However, the decline in sales during the past four months has reduced annual growth this year to just 8%.

If this slowdown continues until the end of this year it seems probable that the total number of sales will be only be marginally better than those achieved 2009, which was the poorest year for sales on record since 2002.

Nationally, the number of properties sold during the first 10 months of 2010 was 7,160. This compares to the 6,615 sold during the same period last year and the 13,261 sold during the first 10 months of 2008.

Unemployment levels in Cyprus are now at a 10 year high having reached a reported 20,846. Nearly a quarter of those who have lost their jobs were employed in real estate and construction related activities.

Let’s not engage in wishful thinking.

1. The problem with Title deeds has been cited hundreds of times. The thing is, it mostly concerns British buyers. Who, although important for the local market, are not a decisive factor. Their withdrawal had a major impact in Pafos, for example, but absolutely no effect on Nicosia.

Therefore let’s face the facts: most of the buyers are Cypriots. And it is their attitude and preferences that we need to bear in mind in the first place. Have you ever seen a Cypriot concerned with lack of title deed? Me not.

2. Public debt at a high level? Very well. Is it at a better level in UK? Hardly so. Somehow nobody predicts collapse of UK property market.

3. Are the sales down? Yes. And will continue to fall. But it is already obvious that 2010 sales will be higher than those of 2009. And judging by the figures, adverse publicity somehow did not prevent foreigners from buying.

4. As for the scarce government resources, do not forget, that they have LAND. A lot of it, actually. Unused. Which can be sold any time. Quickly and profitably.

5. As for the local banks, with all due criticism, they seem not to be as reckless as the ones in UK and USA. Even after much cited crash of Cyprus Stock Exchange in 1999 none of them required bailout. I think they are simply too greedy to be reckless lenders.

Conclusion: we’ll probably see prices of year 2005, reduced sales and collapse of some small developers. Because with current profit margins developers can easily give a 20% discount and still be profitable.

This should come as no surprise to anyone. There is an over supply of properties with little or no demand, therefore prices must inevitably fall. Until this message sinks in with the developers, who still continue to build, then property sales will remain in the doldrums.

The Cyprus government must also address as a matter of urgency the issue of Title Deeds. There has been an awful lot of adverse publicity around this issue, particular in the E.U. and until it is sorted out no one with any intelligence is going to buy a property in Cyprus.

This is further evidence of a train crash about to happen. Your excellent research, including earlier articles, point to a downward spiral of both developers and banks. The two are inextricably linked and Cypriot banks will be desperate for external funding.

Without viable assets to raise such funding – Cyprus has almost nothing outside of real estate which although potentially valuable, would be considered a fire sale in the current market – it is difficult to see how they can achieve this without paying excessive interest rates on the international money market.

Hold on to your non-mortgaged assets and think very carefully about where you invest any cash. The UK stock market or fixed rate UK bonds is relatively safe and very well protected against fraud.

We have seen this coming for a while. Especially with the Title Deeds fiasco. The developers have had the attitude it will not effect us.

Nigel Howarth is becoming “Nuriel Rubini” of Cyprus property market. It’s all dark, now and in the future. But as with Rubini’s economic predictions, it ain’t necessarily so.