REPORTS of an influx of Chinese buyers helping to rejuvenate Cyprus’ beleaguered property market appear to be somewhat ‘enthusiastic’ as property sales last month hit a new record low.

During August a total of 316 contracts for the purchase of property were deposited at Land Registry offices across the island compared with 527 in August last year; a year-on-year fall of 40 per cent.

Of those 316 contracts, 73% (232) were in favour of Cypriot buyers and 27% (84) were in favour of overseas buyers.

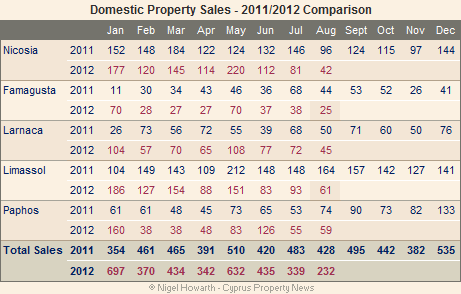

Domestic property sales

Overall 196 fewer properties were sold in August compared with the corresponding month last year; a fall of 46%.

Limassol was hardest hit with 103 fewer properties being sold (-63%). In Nicosia sales fell by 54 (-56%), in Famagusta sales were down by 19 (-43%), in Paphos they fell by 15 (-20%) and in Larnaca they fell by 5 (-10%).

In the first eight months of 2012 sales to the domestic market stood at 3,481 compared with 3,512 in the same period last year; a decrease of 31 (-1%).

Domestic sales are now at their lowest level since records began in 2000.

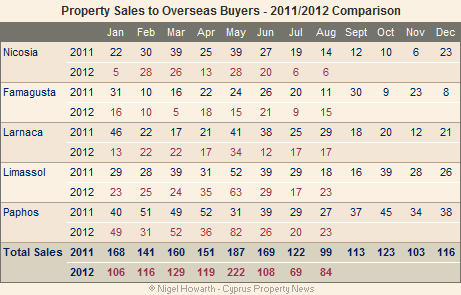

Overseas property sales

Overall sales in August were down by 15 (-15%) compared with the corresponding month last year and are continuing to decline; some areas of the island fared better than others.

On the positive side, 4 more properties were sold in Famagusta; an increase of 36% – and 5 more properties were sold in Limassol; an increase of 28% compared to last year.

On the negative side, 8 fewer properties were sold in Nicosia (-57%), 12 fewer in Larnaca (41%) and 4 fewer in Paphos (-15%) compared with August last year.

During the first eight months of 2012, sales of property to the overseas market stood at 953 compared with 1,197 sales during the first eight months of last year; a fall of 244 (-20%).

A Place in The Sun Live

A final reminder to get your free ticket to the A Place In The Sun Live overseas property exhibition at NEC Birmingham between 28th – 30th September where advice on buying property in Cyprus and many other destinations will be given.

Please don’t place ‘suffocating timescales’ on the Government to accept the Troika’s suggestions, after all February isn’t all that far away now, is it?

Then it will be someone else who is nasty to the workers not Catastrofias and his mates.

MARTYN, your analysis and solution are probably mostly spot-on. However, you appear to overlook the fact that there is no equivalent in the Cyprus Greek patois for the word “reality”.

Now then Nigel, do I detect a hint of sarcasm?!!!

The Troika’s assessment has been with the government for about a month now and nothing has been published or even shared with the other political parties. Also, the Cyprus government is still trying to borrow €5 billion from the Russians. The Troika is reported to be complaining that no response has been offered by the Cyprus government to their assessment and the proposed remedies.

All this says to me that the assessment and the remedies are probably dire and the government is looking for any way around them. I am interested to know how the banks are going to operate in future with regard to security for loans and the size of the loans for purchasing property because these are key factors in the property market. There has been a history of lending to clients with poor credit ratings at inappropriate rates of interest and with reliance on the mortgaged asset to provide security. If all this has to stop, the situation will be reminiscent of the UK in the mid-1970’s when buyers had to save up to 40% of the purchase price to get a loan for the rest, some of which came from insurance companies at high interest rates.

@Mike – There is an ‘interesting’ article in Stockwatch about the drop in sales: Property buyers waiting for troika

So it isn’t the banks, lawyers and developers who are to blame for the drop in sales – it’s those damn technocrats from Brussels and the change in the methodology for assessing non-performing loans!

And neither will there ever be an end in sight to the catastrophic downturn in the Cyprus housing market until such time as the ‘Trinka’ (Banks, lawyers, developers) – the three stooges, realise that they have collectively killed off the goose that was set to continue laying golden eggs for decades.

Government has it within its gift to put an end to the catastrophe but is too frightened of the political fallout to do anything meaningful, preferring instead to continue attempts to hoodwink the potential buying public into parting with their cash in exchange for an almost worthless product which many will never own in their lifetimes and might also be repossessed in order to pay off someone else’s debt.

Who in their right mind would want to squander their life’s savings in that way.

The Chinese are not a gullible as the Cypriots hoped. Where to now? Hopefully for the nation there is a plan Z in reserve.

These statistics only endorse what many of us have been seeing increasingly ‘on the ground’ across the island over the last 12/18 months, origins of which lay in several previous years of denial. The Cyprus property markets, dwellings and commercial, have collapsed. The underlying factors, weak banking, construction and legal sectors plus the outrageous Title Deeds scandal are well known but are now being aggravated by the very late domestic reaction to the ravages of recession that for several years were simply denied, consumers are finally severely restricting spending, 1,000s of businesses are being forced to close down, 1,000s of commercial units are displaying For Sale or Rent boards, car and retail sales are collapsing – and still the Government resists taking the necessary economic, fiscal and social measures to start the deeply remedial processes that are needed – measures that are already being applied, with varying degrees of success, elsewhere in Europe and elsewhere across the globe. In fact one of very few strengths remaining here may well lie within some of the tourism and ex-pat communities still spending, fuelled by plummeting Euro exchange rates against most major currencies.

Only solution now, apart from a new and realistic government as soon as possible, and until Med gas etc start contributing, 2016-20 maybe, is a Cyprus, with Greece, withdrawal from the Euro, a 20-30% devaluation of the ‘new’ Cyprus pound and an urgent solution and clearing of the effects of the Title Deeds fiasco, a 20% reduction in public sector wages and benefits leading to a stimulation of new overseas property buyers and investors, significantly increased tourism and an urgent stimulation of the island’s overall economy. Unlikely of course – but if it were to be tackled this country could achieve a return to ‘boom times again within 5-10 years!

The developers are desperate for business before they go bankrupt. I would not be surprised to see more hype like the Chinese story, in order to encourage sales.

It’s the same old story. No title deeds at point of sale = no sale.

It also helps if the property has the proper amount of cement in the concrete, to prevent it falling apart.