LATEST figures from the Department of Lands and Surveys show that a total of 379 contracts to purchase property were deposited at Land Registry offices across Cyprus in December 2013 compared with the 495 deposited in December 2012; a fall of 23%.

Of those 379 contracts 70% (266) were deposited by domestic buyers, while 30% (113) were deposited by overseas buyers.

With the exception of Limassol, where sales increased 18%, sales fell in all other districts:

Paphos was the hardest hit with sales falling 40%, followed by Larnaca where they fell by 39%. Sales in Nicosia were down 30% and those in Famagusta fell 19%.

During 2013, total property sales fell 40% compared with 2012, falling to 3,767 from the 6,269 sold during 2012.

Speaking to Stockwatch, first vice president of the Cyprus Real Estate Agents Association Solomon Kourouklides said that although there is a demand in the market, transactions cannot be completed due to the banks’ tightened lending criteria and high interest rates.

Domestic sales

Domestic sales in December fell 18% compared with December 2012 and although sales in Limassol went up 26%, sales fell in all other districts:

Famagusta fared worse with no zero properties being sold during December. Sales in Nicosia fell 30%, while those in Larnaca and Paphos fell by 26% and 11% respectively.

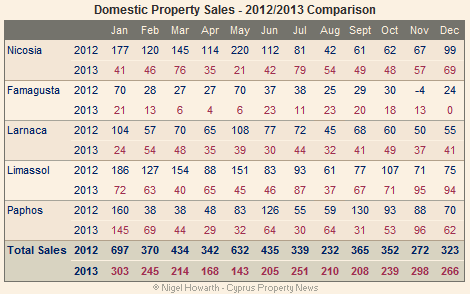

During 2013, sales to the domestic market fell 43% compared with 2012, falling to a total of 2,750 from the 4,793 sold during 2012.

Overseas sales

Sales to the overseas market fell 34% in December compared with December 2012.

Although sales in Famagusta more than doubled and sales in Limassol maintained the same level as the previous year, sales in Larnaca fell by 70%, while those in Paphos and Nicosia fell by 64% and 28% respectively.

During 2013, sales to the overseas market fell 31% compared with 2012, falling to a total of 1,017 from the 1,476 sold during 2012.

My take on the ‘bottoming’ of the Cyprus property markets, STEVE, for what it’s worth:

Given the following Octet of whammies which together must qualify as one of the most massive Black Swan events ever – :

1. Very many sub-standard and , possibly even more!, unfinished properties (many, most even?, caught up in……. (2)

2. Unique, well with Greece apparently, ‘double mortgaging’ to a) developers b) ‘end purchasers’ scams, as part of lax Cyprus banking and regulatory cultures (see 5 below)

3. The outrageous Tile Deeds scams over many years, tens of thousands individual TDs still to be resolved/issued…and still no real plan as to HOW…. together with:

4. Many Developers continuing to ask purchasers to pay IPT on their behalf (because they, the mortgaged developers, seemingly, don’t have the money, or if they do – their banks (or government via IPT) may well be asking for it back!)

5. Cyprus banks still only just STARTING to address (let alone start to deal with!) the very the deep and rancid problems stemming from decades of lax ‘banking practice’ required to be rectified via detailed Troika MOU requirements…….

6. Leading to, very likely, a raft of NPL and Distress property sales which will only cause today’s ‘so called’!, ,market values’ to ratchet down yet further

7. Cyprus governments (previous and present) only NOW, starting to address all the above, and so far, I’d have to say, not very convincingly

8. Cyprus Legal professionals and Estate/Property Agents – with a few exceptions – still contributing to many of the above

Thus quite some way, and time, yet for achieved Property Sale prices to continue to plummet from the Heady Heights of 2007/8 before, Sorry! , the bottoming-out and first green shoots of recovery occur.

There may well currently be some ‘special’ Chinese purchasers in search of EU passports and associated ‘benefits’ and also unknown numbers of Russian and Arab prospects dangling significant cash and ‘few questions asked’ but a sizeable return of numbers of North (and South!) European purchasers to the Cyprus property markets? Not for some time yet!

So, I concur, LEBRAT, keep out of the horrible Tangled Web that is the 2014 Cyprus market (and, also, let President Holland’s numerous mishaps and, we hear, misdemeanours work their own course) as we ‘interested ans many od us ‘involved’! spectators’ here in Cyprus try and see a +ive end to the Current debacle.

Tides do turn of course… But in my view it could be 2017/18 before this occurs in ‘little old Cyprus’, and even then with a sizeable ‘bounce’ on the back of potentially, at this stage, commercially viable MedGas successes. Many Cypriots, we know, continue to believe in ‘the next Miracle’, and MedGas may well be it! Then watch the Cyprus property markets gain real traction again.

Fingers, and everything else, Crossed!

@Jean-Pierre – Thank you for your comment.

The quality of construction work varies greatly and many properties that were built very quickly during the boom years have problems.

Prices here are still not competitive with other popular destinations, but they are lower than Monte Carlo :-)

I believe that Cyprus, at long last, recognises that it has to clean up the property sector otherwise overseas buyers will never return.

Hello Nigel!

I am a civil engineer from France.

I visited Cyprus for the first time in December 2013, interested in the purchase of a home that I could use five/six months a year while it’s too cold in France.

Prior to my trip I have been reading your newsletter for about a year.

Excellent work, the best unbiased real estate info I could find on Cyprus.

One important remark: Considering the poor quality of the constructions in some areas, I feel that most properties are still overvalued and that real estate agents always like to refer to 2007 prices when they are talking about how much of a discount they are given us.

I feel that prices will have to go down further if Cyprus is to remain competitive against countries like Spain and Portugal…then sales will go up

This will also be done as soon as banks start to seriously address non performing loan issues and unload properties on the market….like it was done in Spain with good results.

Most foreigners like me don’t need bank loans…we need to be attracted by a decent price/quality ratio.

The title deed issue is just ridiculous.

A new, proper and strictly enforced legislation must be put in place, in order to restore confidence.

THIS IS A MUST!

Please, keep up the good work…

Best wishes for 2014

Jean-Pierre Lebrat,ing

So…. first vice president of the Cyprus Real Estate Agents Association Solomon Kourouklides says that although there is a demand in the market, transactions cannot be completed due to the banks’ tightened lending criteria and high interest rates. This suggests to me that the sharks are circling as they always do when there are distressed sales and bargains to be had. The irony is that they don’t have the money and the very same banks that were part of the cause of plummeting sales are now the block on increasing sales.

The conclusion I reluctantly come to is that despite all the negative publicity and the internet postings, some of them on this web site, confidently predicting that nothing will be sold on the Cyprus property market (at least to overseas buyers)until the problems are fixed, as soon as prices have fallen far enough, the upward sales pressure will begin to develop despite the problems. I don’t think we are very far from that and it is disturbing because it will encourage the banks to feel they can repossess and sell; bad news for a lot of “owners”