THE TWENTY-third edition of the RICS Cyprus Property Price Index issued earlier today reports that the average price of apartments in Cyprus fell by 0.4% and the average price of houses fell by 0.3% over the second quarter of 2015.

Larnaca saw the largest fall in residential properties with apartment prices falling by 1.2% and house prices falling 3%. On a more positive note, house prices in both Nicosia and Paphos rose by 0.6%.

Elsewhere apartment prices in Nicosia fell by 1% over the quarter, in Paphos they rose by 0.1%, while they remained steady in Limassol and Paralimni/Famagusta.

House prices in Paphos rose 0.6% and remained steady in Limassol and Paralimni/Famagusta.

Compared to the second quarter of 2014, the average price of a residential apartment has fallen by 2.6% and the average price of a 3-bed semi has fallen by 2.3%. Retail property has fallen by 5.5%, while the prices of offices and warehouses have fallen by 1.4% and 2.4% respectively.

Rental values

Across Cyprus, rental values fell by 0.3% for apartments, 2% for houses, 1.4% for offices, 2.1% for retail units and 1.4% for warehouses.

Compared to the second quarter of 2014, apartment rents have fallen 3.0%, House rents by 2.9%, retail unit rents by 6%, warehouse rents by 2.8% and office rents by 3.6%.

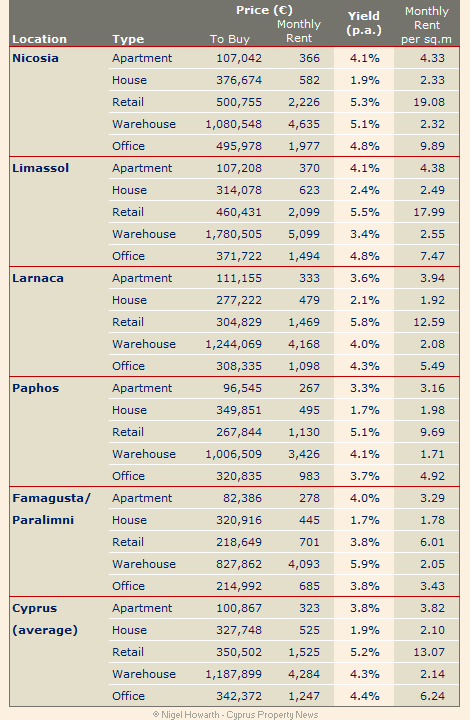

Gross yields

At the end of the second quarter of 2015 average gross yields stood at 3.8% for apartments, 1.9% for houses, 5.2% for retail, 4.3% for warehouses, and 4.4% for offices.

The parallel reduction in capital values and rents is keeping investment yields relatively stable and at low levels (compared to yields overseas). This suggests that there is still room for some re-pricing of capital values to take place, especially for properties in secondary locations.

Commentary

Speaking to Stockwatch, Charalambos Petrides MRICS, said that: “The downward trend in real estate prices continued on an annual basis. It is interesting that in the first and second quarters of 2015 for the municipality of Paphos and Famagusta the drop in prices has stopped thus annual losses have been reduced.

“What is positive in the first quarter of 2015, compared to 2014 and 2013, is the increased marketability, by about 20% annually. It seems that property transactions have rebounded and price reductions restore market activity.

“With regard to real estate prices, the downward trend is expected to continue on an annual basis in 2015 perhaps with smaller losses compared to 2014. In anticipation of developments in the banking sector, particularly as regards to non-performing loans, the strict lending policy market, the high interest rates and the foreclosures, the property market is in a downtrend.

“The legislation on foreclosures that has passed by parliament is a positive development and is expected to have a positive impact on non-performing loans and real estate over the longer term”.

Prepared by RICS Cyprus in conjunction with the Cyprus Association of Quantity Surveyors (SEEOKK) and the Cyprus Valuers Association (SEEAK), the quarterly RICS index monitors property prices and rents in all districts using a methodology developed by Reading University in the UK.

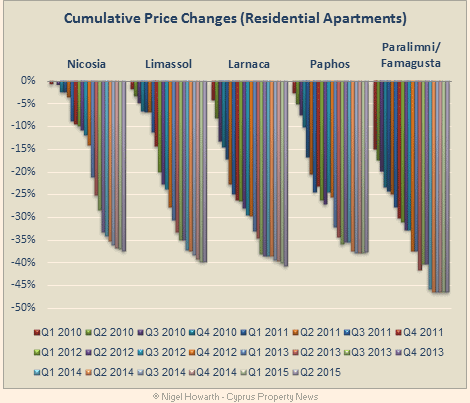

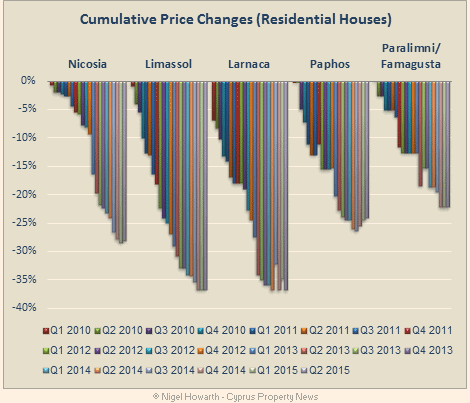

Residential property prices

Since the first RICS Cyprus Property Price Index was published for the first quarter of 2010 residential house prices have fallen by an average of 29.7%, while those of apartments have fallen 40.3%.

(Note that the RICS Price Index does not include prices of holiday homes and all properties used to construct the index have clean Title Deeds.)

Prices will fall and why shouldn’t they? Who’s going to buy? Who’s going to rent?, We need population and that’s something we’re not going to have. These guys should really get their teeth knocked out, I hope and very rarely I am wrong, I can see property values here dropping by at least 40% , the figures by Cyprus RICS are heavily misleading.

Trust me I’ve been in property for over 30 years, the market is a mess and the banks have no money, don’t believe what you read hyping up the market which doesn’t exist.

Once the result of the Aristo case becomes more widely published I’m afraid these sales figures are going to drop even further. It just highlights how corrupt the whole system is, with everybody in each others pockets. This is from the banks to the developers and includes solicitors and now the legal system.

It would be interesting to find out how many of the past Aristo developments have actually issued the title deeds to the purchasers and how many sites are classed as Aristo stock. That is sites that have been completed but still remain the property of Aristo. Millions I’m guessing