For readers who have not heard the term ‘trapped buyers’, they are people who were deceived into buying property in Cyprus built on land that its developer had earlier mortgaged to a bank.

Back in 2015, as part of the bailout conditions with the Troika of Cyprus international lenders, a ‘trapped buyers’ law was introduced. This aimed to help some 70,000 who had paid for their properties in full but could not get their Title Deeds because the developers had mortgages on the properties. (Developers’ land and buildings are counted as assets that need to be offset against their debt to banks. This gives banks first claim on properties mortgaged by developers, including those they’d deceived home buyers into purchasing.)

However the banks, who naturally wanted to protect their interests, challenged the law in court. Judges ruled that the law was unconstitutional as it violated the article in the Constitution that gave people the right to enter freely into contracts. As a consequence, many ‘trapped buyers’ remained trapped.

But there appeared to be a breakthrough at the end of June last year, when it was reported that a ‘gentlemen’s agreement‘ had been reached; MPs would approve laws making it easier for banks to collect their dues in exchange for banks not raising objections to trapped buyers getting their Title Deeds, providing that the purchase was done in good faith.

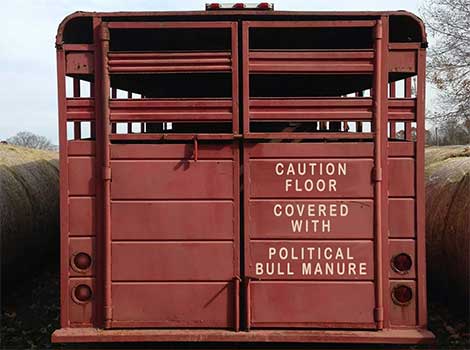

(The obvious problem, of course, is that a gentlemen’s agreement must be made between gentlemen.)

The law making it easier for banks to collect on their dues was subsequently approved; no action from the banks.

At the end of October chairman of the house finance committee Averof Neophytou promised to come down hard on the banks if they went back on their pledge not to oppose the implementation of the trapped buyers’ law.

But earlier this week it was announced that the Estia scheme will be launched officially in March. This is a debt-relief scheme for vulnerable homeowners whereby the state contributes towards the repayment of their loans on primary residences that have become non-performing.

Rather than coming down hard on the banks as Neophytou promised, this scheme actually helps banks reduce their non-performing loans while the tax-payer picks up the bill. As we reported on Wednesday the Bank of Cyprus alone said that €900 million of its loans are eligible for the Estia scheme.

If only the government would keep its promises and bankers act like gentlemen, the trapped buyers mess would be resolved by now!

In August 2016, I ran an article in Financial Mirror entitled “Recidivism: The Curse on Cyprus”, which I believe Nigel may have re-run on this site at the time.The gist was that, three years after the Cyprus financial collapse and a miraculous turnaround by the Anastasiades government and a bailout exit in record time, all of it stood in jeopardy because of super-powerful recidivist forces within the administration, the banks, the property industry, the judiciary, and society itself. That absolute refusal to change from the catastrophically bad practices and attitudes that resulted in the 2013 collapse remains as steadfast today as it was six years ago.

The fact that in 2019 trapped buyers are still being given the runaraound on their hostaged title deeds, and the banks have become the largest estate agents owing to pick-up of distressed properties, says it all. The banks appear to be no further forward with the toxic property debt bubble they were holding six years ago that was a large contributor to the 2013 financial collapse.

As I noted in the 2016 article, unless recidivism is cleared out wholesale then Cyprus is likely to to hit another 2013 style financial crisis within the next five years i.e. 2021.

Ed: I did publish your article Alan – Recidivism: the curse on Cyprus. Unfortunately it looks as if little has changed.

Sometime ago I wrote a comment suggesting that we wouldn’t see a resolution of this terrible mess, for exactly the same reason that Nigel now confirms,

“a gentleman’s agreement” has to be between gentlemen.

The government has no interest in solving this issue for the vast majority of “trapped buyers” – expatriates who were caught by the lies of lawyers, banks and developers.

Why not? Because we don’t vote for them!

Of course they solve it for the voters, they want to be re-elected.

Stand by for more lies, excuses and political games.

Averof Neophytou come down hard on the banks? of course he won’t! the banks are all run by his friends and contributors to the presidents re-election fund.

Thank you Nigel for your continued interest in this subject.

Ed: This mess has to be sorted. I’m sure if it ever reached the European Courts the banks wouldn’t have a leg to stand on.

“venerable homeowners”! Predictive text maybe? Vunerable?

Ed: Thanks – damn computers!