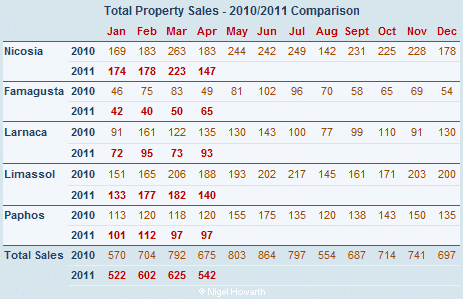

ACCORDING to the Department of Lands & Surveys’ figures published earlier today, the number of property contracts deposited at Land Registries throughout Cyprus in April was 542 compared with the 675 deposited in April last year; a fall of nearly 20%.

During the first quarter of 2011 property sales have fallen by more than 16% compared to last year and are just 4% higher than the number sold during the first quarter of 2009 (which was the poorest year for sales since 2002).

Sales during the first quarter were down in all areas. The areas worst affected by the downturn are Larnaca and Famagusta, where sales are down 35% and 22% respectively compared to last year. Sales in Paphos fell by 14%; in Limassol they fell by 11% and in Nicosia, the capital, they fell by 10%.

The level of unemployment and the fact that home loans in Cyprus are amongst the highest in the eurozone have contributed to the downturn in domestic sales.

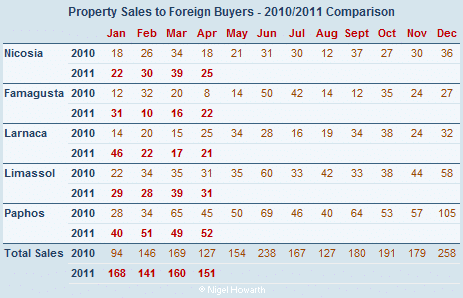

However, from the figures published by the Department of Lands & Surveys, it is the domestic demand for property that is faltering; foreign demand for property Island-wide is steadily increasing.

Overseas sales

Property sales to foreign buyers increased in April with a total of 151 contacts in favour of foreigners being deposited compared with 127 in April 2010; up by 19%. Famagusta fared particularly well with sales to foreign buyers during the month rocketing 175%!

Unlike domestic demand, foreign demand for property continues to improve, perhaps encouraged by government statements that the recently amended laws will provide additional protection for consumers.

Over the first quarter of 2011, total sales to foreign buyers have increased by more than 16% compared to last year – and sales are up in all areas.

Larnaca leads the way with sales up 43%; followed by Nicosia (+21%), Paphos (+12%) , Famagusta (+10%) and finally Limassol (+4%).

As we reported on Monday, BuySell Cyprus’ sales manager Chris Hadjikyriakos said that Russian buyers accounted for 60% of the company’s total sales compared with no more than 10% just three years ago.

Why do people buy lottery tickets when the odds against winning are more than 40 million to 1? For many, it’s because they believe their numbers are special and the odds for their numbers are much lower. Why have over 600 foreign buyers bought property in Cyprus during the first 4 months of this year? Many of them probably know all about the goings-on in the Cyprus property market, but they want to believe it will not happen to them (rather like people who drive like lunatics and believe accidents only happen to other people – plenty of those in Cyprus!), so they hang on to those reassurances we have all seen in the estate agents’ and developers’ blurb (remember the ones saying that the Cyprus property law is based on UK law so nothing to worry about, your purchase is safe?)

The depressing side to this is that so long as these optimists keep buying property in Cyprus as if they were buying lottery tickets, there is little effective pressure on the authorities to clean up the current rotten system.

The latest amnesty just makes things worse for many caught in the trap.

@Howard – I received two copies of the email yesterday, I don’t know how the company managed to get hold of my addresses.

International ratings agencies Standard & Poor’s, Moody’s and Fitch have referred to issues in the Cypriot economy relating to banks’ exposure to Greece, public sectors wages, and in March Moody’s said:

“…while net problem loans (problem loans net of provisions) are fully covered by tangible (mostly real estate) collateral, the recent downturn in the real estate market has had a negative impact on the liquidity of the market, leading to concerns over the recoverability of such collateral.”

But it is interesting that a Cypriot has said this. If it had been anyone else they would have probably been thrown in jail for causing a general panic amongst the population.

The company is using a FUD (Fear, uncertainty and doubt) tactic in efforts to increase sales, which as you can see above, are not very good. It must be pretty desperate for business!

Howard.

Some people would think that keeping money under the mattress is as safe a bet as any or, on a more practical level, in a safe deposit box.

Depending on one’s level of wealth, I agree that property CAN be a good hedge. However, can I assume that you DON’T have a particular island in the eastern Mediterranean in mind when it comes to investing in bricks and mortar?

I got an e-mail from an estate agent yesterday. This is most of what it said:-

What the Cypriot banks do not want you to know?

Your valuable cash or bank deposits are just a piece of paper or a worthless number on your bank statement and is not guaranteed that can be converted to the things you dream for.

From 2008 to 2011 we have seen a sharp drop in property prices averaging 25% for houses and 35% for apartments. In some cases, apartment prices fell 50%. All Cypriot banks are exposed to high risk of unsecure loans because of the drop in property prices. Most of the mortgages done from 2003 to 2008 are in extremely high risk because mortgages are higher than the actual property value. Banks contributed to the sale of thousands of so called investment properties which were extremely overpriced. But, the bubble burst and banks are left in the cold and investors are locked in.

A further reduction in property prices can be catastrophic for banks.

If they put pressure on developers and home owners to pay their mortgages, the developers and home owners will need to decrease prices even further in order to sell. This will cause the whole system to collapse since mortgages will be much higher than the actual mortgaged properties and no one will be willing to pay a €400,000 mortgage for a €200,000 property, for example.

What you can do if you have a mortgage higher than the value of your property?

The best option would be to renegotiate your mortgage. Banks have created the bubble and now banks must absorb the cost.

How likely is it for Cypriot banks to collapse?

Some Cypriot banks can collapse in one night if people decide to stop paying their mortgages or if people decide to withdraw their deposits. The government will try to save the situation but if more than one bank follows the collapse chain nothing can stop it. But if you have deposits, you should be psychologically ready to lose your money, unless you protect your wealth with some smart moves. You should always know that cash in the bank is very vulnerable. If your bank collapses, your valuable lifetime deposits will disappear.

Think again! Your valuable cash or bank deposits are just a piece of paper or a worthless number on your bank statement and is not guaranteed that can be converted to the things you dream for.

Banks are just tricking you to keep your deposits and pay your mortgage payments because this is how they make money.

If governments decide to print new money, your valuable deposits will be worth much less or nothing.

What should you do to protect your cash and bank deposits?

Keeping your wealth in money and cash is a bad decision. There are only two options, either you buy gold and or you buy property. Gold at the moment is expensive and difficult to keep safe and secure. On the other hand, buying property is the safest bet because you can find bargain properties at the moment and whatever happens with money and inflation, the property will adjust its value to the market conditions. A property will secure your wealth in case of a bank collapse or hyperinflation effect.

Money as debt – no actual money exist, all is an illusion!

We all know that property prices go up when there is demand. Demand for property is created only by an increase in population.

If you think that your money in bank is safe then think twice. Many people’s hard earned lifetime saving were lost. People tend to think that they have wealth but suddenly they found out that they are just left with a piece of a paper with a number on it. Lehman brother’s bank collapse was just one of the many cases.

The safest way to keep your wealth is NOT HAVING MONEY IN THE BANK!

Invest in economic sectors that can raise their prices or adjust their value as the prices increase. Treasury Inflation-Protected Securities (TIPS), commodities (like oil and metals), and real estate are generally safe bets keep your wealth.

Please drop me a line, what do you think.

Keep your hard earned wealth safe,

Keeping cash in the bank is too risky,

We can find you a property bargain!

Low price properties for sale on our website!

If property sales to foreigners are increasing are we to assume that foreigners really are as stupid as their actions indicate or are they just incapable of accepting the warnings of the risk they are taking and are still being seduced by the Sun, Smile and sales promises.

It could be that all properties sold have readily available title – I know, but one can live in cuckoo land, it’s not a crime (yet)!

We are probably witnessing the next generation who will be left with worthless properties without title for the next 20 years unless they choose to pay off the developers debts for him, in which case I admire their philanthropic demeanour & just wish I was able to bring myself to do the same. Sadly I am of the old fashioned belief that I pay an agreed price for a product in return to be able to claim ownership not the agreed price plus current owners debts.