SINCE the Royal Institute of Chartered Surveyors (RICS) published the first issue of its Property Price Index back in January 2010, we have been tracking property prices and how these have changed in different areas of the Island over time.

Since the first quarter of 2010, average prices for residential properties have fallen by 17%; a 15% drop in house prices and a 23% fall in apartment prices.

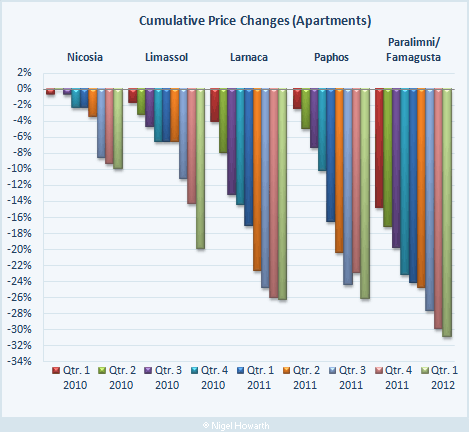

Apartment prices

It is perhaps not surprising that apartment prices have fallen by more than those of houses. There has been much speculative building of apartments in the seaside towns, which has resulted in a massive oversupply in those areas.

Since the first RICS Property Price Index was published, prices of residential apartments in the Paralimni/Famagusta area have been the hardest hit, with prices falling by 31%. Although not recorded in the Index, anecdotal evidence suggests that prices of holiday apartments designed for the overseas market have fallen still further and that ground floor apartments and penthouses are being bought by Nicosians, looking for a weekend retreat, at knockdown prices.

Prices of residential apartments in the Larnaca and Paphos areas have fallen by around 26% and, as for Paralimni/Famagusta, prices of holiday apartments designed and built for the overseas market have faired worse.

Apartment prices in the mainly residential areas of Limassol and Nicosia, the capital, were holding up fairly well until the third quarter of 2011, when they started to decline more sharply. This was probably as a result of fears over the worsening economic situation and the uncertainty and chaos that followed the destruction of the Vassilikos power station by a massive explosion of carelessly stored munitions.

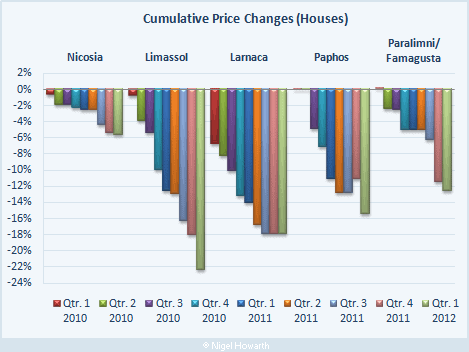

House prices

House prices have faired better, although there was a sudden decline in the third quarter of 2011 in Nicosia and Limassol, the major business centres of the Island, following the destruction of the Vassilikos power station.

House prices have dipped sharply in Limassol, falling by 22% since the first quarter of 2010. As reported in the RICS Property Price Index that we published yesterday, Limassol was the least affected area until the second half of 2011 and the one that has experienced the greatest reduction in interest by overseas buyers.

House price falls in Larnaca may have stabilised at -18%; no falls have been reported over the past three quarters. Prices in Paphos have fallen by 16% and they are down 13% in Paralimni/Famagusta. Nicosia remains the most resilient area with house prices falling by just 6% since the first quarter of 2010.

The future

The economy still has problems although the result of the recent Greek elections has “pulled Cyprus back from the precipice” according to a Reuters report. Had the Greeks voted for the leftist Syriza, it’s been estimated that Cyprus would have needed €10 billion or more if Greece were pushed out of the Euro.

As things stand, Cyprus needs Cyprus needs to raise 1.8 billion Euros by the end of the month to recapitalise the Popular Bank plus a further 3 billion Euros or so to refinance the public debt. Whether it will get this money from Russia or the EU is unclear, but most commentators believe that Russia is the odds-on favourite.

The Russian newspaper ‘Nezavisimaya Gazeta’ printed a story under the headline, “?????? ???????? ????????? ?????” (Moscow buys the Cyprus economy); most appropriate in the circumstances!

If the government can take the necessary steps to improve the economy, reduce unemployment, ease money supply and restore confidence, we may see a slowdown in the rate of price falls or possibly a reversal of the downward trend in the more popular residential areas of the Island.

However, Title Deeds (or rather the lack of them) remain the ‘elephant in the room’. Although the government introduced legislation last year designed to improve consumer protection, it still has much work to do to fully resolve the problems.

Some investors are still buying Nigel because some property agents and salespersons are still telling whopping porkies about the Cypriot property market.

I regularly respond to agents marketing emails and you should see some of the cr*p they are still spouting about all sorts of things including statements such as “If you are an EU national you can stay in Cyprus for as long as you like without applying for permanent residency” and Title Deeds will normally be available approximately 1 year after you complete your purchase”.

These are some of the better statements from some of the more ‘legitimate’ agents who sellers may think they can trust.

@Odd_Job_Bob – why are some investors still buying? I guess they enjoy playing Russian roulette – or they haven’t done their research properly.

Marktyler and Nigel have hit on some VERY good points. Not only do you have to deduct all the running costs from the gross yield (and, as mentioned by many on this forum, these costs are growing disproportionately as local authorities, utility companies, mortgage lenders, developers’ management companies etc are all strapped for cash and WILL SQUEEZE YOU for as much as they can for ever diminishing standards of service) but, if you factor void periods and non-payment of rent into the equation (in a system which appears specifically designed to HEAVILY favour the tenant, it would be interesting to find out what percentage of annual rent is actually paid…?), I would suggest that, until even bigger falls are factored in, Net Rental Yield is pretty much a negative figure.

Q: if none of the fundamentals of property investment work here (negative net rental yield and negative appreciation), why do property investors still build and buy (unless they are just thick, which I suppose may be the case for some)?

A: For reasons that, again as stated before, have nothing to do with property fundamentals and all to do with fraudulent acquisition of (initially, at least, due to EU membership) low rate developer loans and money laundering.

So, if you are thinking of investing in Cyprus property for overall returns, simply re-read the last line of marktyler’s post!

@marktyler – the other thing to bear in mind are the figures reported by RICS are gross rental yields.

So you have to deduct local taxes, utilities, insurance, maintenance and repair, etc.

And for blocks of flats and other complexes with shared facilities with shared facilities such as swimming pools, entrances and stairwells, gardens, etc. you’ve got the additional costs of communal charges paid to the management committee.

I certainly agree that very low rental yields imply property prices have only just begun their Southward journey. Shocking though this already may be, I suggest investors should not remain “in denial”. When you buy property for its yield (and an extremely low yield it is too!) you hope tenants will honour contracts with the landlord, and pay monthly. If they do not? The Courts are asleep at the wheel. Asleep for years, the Landlord will wait a very long time to achieve “Damages”. Probably give up, which is the idea implicit in the rigged system.

The Cyprus property market is a No-Go area for investment for all sorts of reasons.

I like what Mary said ..give the money to the people not the banks, a lovely idea, I’m sure. Yes it would lift the gloom off Cyprus and quickly too. maybe even a lot cheaper than a bailout. only one slight problem , the banks are not there to help the people, just stuff them.

@Ron Richardson – I guess you bought the property as an investment?

Property should be viewed as a long-term investment – 10 years or more.

Many people were caught by the sales pitch that they could buy off-plan and then sell when the property had been built at a substantial profit.

They didn’t question the developers/agents – if prices are going to rise so much, why don’t you wait and sell the properties when they’ve been built.

@John Swift – You cannot really compare the prices of property in the UK with those in Cyprus – it’s like comparing apples with oranges.

Prices are driven by demand – if there is no demand, then prices will continue to fall.

I was in Lebanon last year (not the most stable of countries). Prices of apartments in down-town Beirut are a good deal higher than anything in Cyprus.

My view is that until Cyprus properties return to their previous values against UK properties ie ‘you could sell up in the UK and have money left over after buying your Cyprus property’

The market will have to fall considerably more to entice UK customers back.

My UK house in Derbyshire is currently valued at 190K euros which at this moment in time would hardly buy anything in a decent location in Paphos.

I do hope this nightmare is nearing a level where we can say we’ve turned the corner, and things have turned the other way, i think we are very close to that point.

There must be countless tales of woe that people can recount. Myself I own a bungalow on Kamares and it is for sale through a very reputable developer. But should it sell at our pre-agreed price, I would be looking at a 100k euro loss. That’s not what i signed up for. But, I was in for the long haul from the start and selling was an option, but not the best option.

Lets hope its uphill from here on.

Ron Richardson

Hi Nigel,

It beats me on how a country (Cyprus) who is a member of the EU and who has a lot of capital locked up due to the bad management of its affairs and of not making a good effort in recouping this cash. How stupidly can they apply for a loan from a non EU country and get it thus allowing itself to get deeper into the mire. Yes there may be a lot of gas etc. around our shores but who will end up with the profits from it. Russia??

I know of another Island that ended up in the same boat and are having difficulty in getting out of the mire with false promises.

Regards.

Please excuse my ignorance, but if Cyprus needs 1.8 billion, and if they get it where ever. Why don’t they give 1 million to each resident and say that you are not allowed to take the money out of the Country you must invest in Cyprus or pay it in the bank for the million to work for the Bank.

We only have 1 million residents in Cyprus and this way the Bank will receive the 1.8 billion and give every single person in Cyprus the opportunity to invest the money the way they wish (probably better than the bank). This way Cyprus may be a better place for tourist, new business will form and Cyprus could become one of the best countries to visit. Why should the Bank receive it, when it is them who lost it by bad investments, we the people may have not made a bad investment, but because of the banks we have all lost, we cannot even go to the banks to help. Help the people not the Banks.

Perhaps one solution would be for the Cyprus Banks to sell their non-performing Developer loan book to the Russians so that Sergei can come round with the boys to take back ‘their’ assets?

I agree that Russian funding, “buy-out” is odds-on favourite: but will they impose the kind of severe austerity measures needed, especially tackle the massively inefficient! Overblown Public sectors? Doubt it.

So Cyprus continues to fall in terms of competitiveness with other countries, holiday/leisure destinations. But the Russians will be delighted to ‘own’ a south-eastern outpost neatly in the Eurozone and poised it seems to become a wealthy oil/gas nation-state within 5-10 years.

Will the Cyprus government use this period to address the fundamental faults in the construction, property and especially banking/financial and legal professions that have seriously contributed to the mess the Cyprus property markets are now in? Answers on a small postcard please!

Hi Nigel,

With the greatest respect, Rental yields are indeed A TOOL to be used in ascertaining true property values but are really only less than half the story. The ONLY important thing is OVERALL RETURN, which is Net Rental Yield (rent obtained minus the costs of obtaining it) + Property Appreciation (how much it grows buy).

For example (and leaving out the running costs for the time being): imagine we have a property valued at €100,000 for which we get €3,800 p.a. rent (at the 3.8% average for flats you mention). Let’s say that, over a year, this loses the 25% that Pavlos Louizou mentions.

So, the New Property Value = €75,000, New Rental Yield (assuming tenants pay the same) = €3,800/€75,000 = 5.07%, Increase in Rental Yield = 33.33%, but Total Return = €75,000 – €100,000 + €3,800 = €-21,200, so Total Loss on your €100,000 investment is 21.2%, even though your rental yield has leapt up!

Using Rental Yield in isolation to attempt to justify why “real estate will become attractive again compared to fixed term deposits†is disingenuous at best.

Hopefully, no-one buys into this nonsense.

@Odd_Job_Bob – Rental yield is a useful in determining whether property is under-valued or over-valued.

Rental yields for apartments are low (3.8%) and houses are very low (2.0%) – which indicates that they are over-valued.

(Also, if someone is looking to invest in property, rental yields is something they will take into consideration).

Far be it from me to be contradictory (ahem…), however:

It is possible to have a rental investment that produces infinite rental yield! (i.e. the property value is zero).

The strength of a currency is a reflection of the strength of the economy that produces that currency. If the Euro has lost 25% over the last coupla years to Sterling, THERE IS A REASON FOR IT (i.e. the very existence of THIS particular currency is under threat).

If “the deteriorating situation of the local economy†still hasn’t caught up with us yet and thus hasn’t been factored into the downturn in prices, logic would suggest that further falls will take place.

So, logically speaking, if high rental yield is your reason for purchasing property which will be denominated in a tanking currency in a tanking market which is almost GUARANTEED to get worse (without even mentioning the legal problems here), then you really shouldn’t be allowed out of the house without a responsible adult or anywhere near a cheque book.

Hopefully, for their sakes, (he says, crossing all fingers and toes) the “new wave of buyers†are a fanciful notion which will NOT materialise.

There, that was me being less conflictual.

As for Nigel’s question, the ONLY viable option for the banks is to write off the developers’ debts and sell the repossessions as a package to 3rd parties (last option). Knowing Cyprus, these 3rd parties are most likely to be the developers who got into the mess in the first place.

Plus ca change…

Property prices will continue to fall, although perhaps at a slower rate.

The market in Cyprus has suffered, like most countries, due to the economic crisis. The other countries are likely to recover quicker than Cyprus.

Until the Cypriot government create a system which gives a purchaser a clean title deed at point of sale, the sales of newly built property will never recover.

Recovery will only occur in resale property that has a clean title.

@Pavlos – thanks for your insight into what the future holds.

I understand that many developers are heavily in debt as they have mountains of unsold properties on their books that they cannot sell. Banks loaned them the money to build these properties but as they are not selling, the developers are unable to repay their loans.

I believe that the banks are rescheduling these loans to give the developers some breathing space and are charging them something like 14% interest for the privilege.

There has to come a point at which these properties cannot be sold, because they will have to be priced much higher than similar properties because of the money owed to the bank by the developer.

So what will happen?

Will the banks allow these developers to sell at a loss and write-off part of their debts?

Will the banks recover the properties and try to sell them on the open market to recover the debt (assuming they can find someone to buy them)?

What are the banks going to do with thousands of properties that no-one wants to buy and that will continue to fall in value unless they are maintained in a condition ready for sale?

Will the banks ‘sell’ the debts to a third party who, in two or three years time when things have hopefully improved, will sell the assets?

I’m not asking you to answer the question, but I cannot see any easy way out of this mess.

Pavlos Loizou.

Keep telling it like it is. Your country needs you.

I presume that your final sentence is a cleverly worded reference to the fraudulent shenanigans perpetrated by certain developers, lawyers and financial institutions with regard to title deeds.

Dear Nigel,

I would expect property prices to continue falling up to the point where property yields, i.e. annual rent divided by price, reach at least 6.0% (they are currently around 4.0%). This would imply a further fall of 20%-25% for prices in Nicosia and Limassol and probably another 10% in Paphos, Larnaca and Famagusta.

The reason for this fall is the increasing cost of debt and the deteriorating situation of the local economy. Cypriot banks have not yet been re-capitalized, there hasn’t been a haircut on Cypriot government debt (yet), and government debt continues to spiral upwards. Unfortunately, all of these are likely to catch-up with us all during the first half of 2013 (after the presidential elections).

However, as property prices fall and the ratio of rent to price begins to increase (the property yield mentioned above), I expect that buying real estate will become attractive again (compared to fixed term deposits). Also, prices may have fallen by circa 20-30% but the exchange rate between Sterling and Euro has increased by circa 25%. Thus, for a UK investor/ buyer prices have fallen by more than 40-50% since 2010.

I hope that the new wave of buyers reviews your website and is prudent in their acquisitions. The last thing we need is more people being caught up in the legal mess and fraudulent bureaucracy that characterises the local property market.

Just a quick point,

The apparent plateauing of prices in the last quarter may be due to seasonal demands in property and the Government incentivasation schemes (before they were extended), rather than a genuine improvement in the market.

If anything, more uncertainty than ever looms over the EZ

PK