ACROSS Cyprus, prices of residential houses and apartments fell by 1.1% and 1.0% respectively during the second quarter of 2014 according to the latest quarterly RICS Cyprus Property Price Index.

The largest falls were reported in Paphos, where house prices fell by 2.1% and apartment prices fell 2.8% over the quarter. Across the island the values of retail properties fell by an average of 3.0%, while those of offices and warehouses fell by 2.2% and 2.6% respectively.

Annualised property price falls

Compared to the second quarter of 2013, the average price of a residential apartment has fallen by 7.8% and the average price of a 3-bed semi has fallen 3.9%. Retail property has fallen in value by 10.4%, offices by 8.3% and warehouses by 8.3%.

Overall price falls

Since the first edition of the RICS Cyprus Property Price index was published for the first quarter of 2010 residential house values have fallen by an average of 28%, while those of apartments have fallen 39%.

(Note that the RICS Price Index does not include prices of holiday homes, which anecdotal evidence suggests have fallen in value considerably more than those of residential properties.)

Rental values

Rental values recorded a quarterly drop of 1.3% for apartments, 0.3% for houses, 4.3% for retail units (shops), 4.5% for warehouses, and 1.0% offices.

Compared to the second quarter of 2013, rents have fallen 7.6% for apartments, 7.9% for houses, 16.6% for retail units, 8.2% for offices and 11.6% for warehouses.

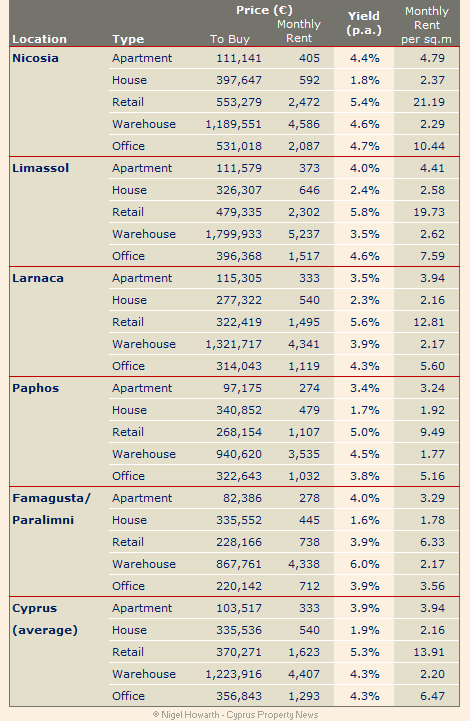

Gross yields

At the end of second quarter of 2014 average gross yields stood at 3.9% for apartments, 1.9% for houses, 5.3% for retail, 4.3% for warehouses, and 4.4% for offices.

Contributing professional bodies

Profile of RICS

RICS – the Royal Institution of Chartered Surveyors – is the largest organisation for professionals in property, land, construction and environmental assets, worldwide. The organisation was created in 1868 and now has over 140,000 members in 146 countries. RICS Europe is based in Brussels and represents 17 national associations, with over 8,150 members in Continental Europe. Visit www.joinricsineurope.eu and www.rics.org for more information.

Profile of ?EEOKK

The Cyprus Association of Quantity Surveyors and Construction Economists (??????) is the association that represents Chartered Quantity Surveyors and Quantity Surveyors whose main area of work is in Cyprus and they permanently live in Cyprus. Visit www.seeokk.org for more information.

Index parameters and methodology

Methodology

The methodology underpinning the RICS Cyprus Property Price Index was developed by the University of Reading, UK. The report may be viewed by clicking here.

Coverage and Variables Monitored

The RICS Cyprus Property Price Index monitors the urban centres of Nicosia, Limassol, Larnaca, Paphos and Paralimni-Famagusta. The Index only tracks prices in Republic of Cyprus’ government controlled area and not in the occupied North.

In each of these centres, the index monitors the Market Value and Market Rent, as defined in the RICS Red Book, across the four main property sectors – office (CBD), retail (high street), industrial (warehouse) and residential (houses and apartments).

Recognising that there are sub-districts within these urban areas which operate and behave in a varying manner, a number of these is monitored in order to derive the composite index for each category per urban area.

The information provided in this publication is based on the average price and rent of the sub-districts monitored per urban centre per sector. The complete list of these sub-districts can be found in the University of Reading’s report which may be viewed by clicking here.

Nature of Notional Buildings

The RICS Cyprus Property Price Index monitors hypothetical or notional buildings, each having specific characteristics. Details of these hypothetical properties are provided in the University of Reading’s report.

The provided price per sqm is based on the Gross External Area of the property (as defined in the RICS’ Code of Measurement Practice 6th Edition), which includes the living area and covered verandas but excludes common areas.

Surely this should be headed as “Property prices continue on their path to realistic levels not seen for almost a decade” The Paphos district are to be congratulated for achieving the largest re-alignment this quarter and although still have a long way to go can be seen to be the most successful in almost reaching a level which will again trigger interest and demand in the property market.

As long as the banks do not start lending prices will continue to. Fall , this will help the banks forclose on properties for nothing and we will still layble for the balance of the loan.