THE LATEST Cyprus Property Price Index published by the Royal Institute of Chartered Surveyors (RICS) reveals that the average price of houses and apartments fell by 1.1% and 0.7% respectively during the fourth quarter of 2014.

The largest quarterly falls were reported in Nicosia (1.1% for apartments) and Famagusta (3.6% for houses).

Values of retail premises fell by an average of 1.6%, values of offices fell 1.2% and values of warehouses fell 1.9% over the quarter.

Compared to the fourth quarter of 2013, the average price of a residential apartment has fallen 5% and the average price of a 3-bed semi has fallen 5.4%. Retail property has fallen in value by 8.1%, offices by 6.1% and warehouses by 5.3%.

Commenting on the latest Property Price Index, Charalambos Petrides from RICS Cyprus said: “It seems that transactions have rebounded and the price fall restores activity with increased property sales.

“Real estate prices are expected to continue declining in 2015 in view of developments in the financial sector, particularly as regards non-performing loans, strict lending policy and high interest rates.

The market is affected by increased property taxes and the issue of foreclosures on mortgaged properties, preventing the market from stabilising.”

Overall property price falls

Since the first RICS Cyprus Property Price Index was published for the first quarter of 2010 residential house values have fallen by an average of 30%, while those of apartments have fallen 40%.

(Note that the RICS Price Index does not include prices of holiday homes.)

Rental values

Rental values recorded a quarterly drop of 1.3% for apartments, 0.2% for houses, 0.4% for retail units and 0.9% for warehouses. On a brighter note, the rental value of office increased by 0.2%.

Compared to the fourth quarter of 2013, rents have dropped 5.0% for apartments, 3.1% for houses, 8.9% for retail premises, 2.9% for offices and 8.8% for warehouses.

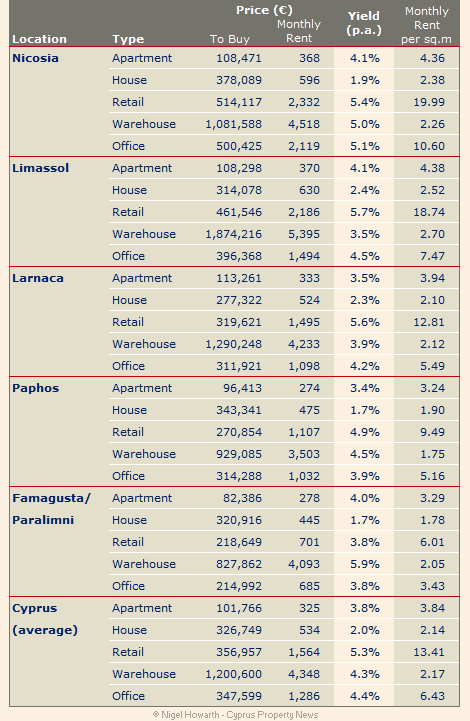

Gross yields

At the end of fourth quarter of 2014 average gross yields stood at 3.8% for apartments, 2.0% for houses, 5.3% for retail, 4.3% for warehouses, and 4.4% for offices.

The parallel reduction in capital values and rents is keeping investment yields relatively stable and at low levels (compared to yields overseas). This suggests that there is still room for some re-pricing of capital values to take place, especially for properties in secondary locations.

Professional bodies contributing to the Property Price Index are RICS Cyprus, the Cyprus Association of Quantity Surveyors and Construction Economists (??????), and the Cyprus Association of Valuers and Property Consultants.

Characteristics of the properties used to compile the index and the methodology employed was developed by the University of Reading, UK. The document may be viewed by clicking here.

@ Nigel, thanks again for your reply.

Yes speculators or George Soros even wrecked the £ sterling.

In your opinion are Russians buying less in Cyprus due to the Rouble etc?

I don’t think they released those stats yet. I’m looking forward to seeing them.

@Mike G on 2015/02/11 at 1:14 am – I’m sure the fall in the value of the Rouble will have some effect and I read that Putin is calling on Russians to repatriate overseas deposits.

The foreign sales stats still haven’t been published and they do not give a breakdown on nationalities – so we can only see the general trends.

@ Nigel- Thanks for the good answer Nigel. A billionaire without NPLs I suppose. I’d be happy to be a mere millionaire or even a few hundred thousandaire… Yes you right about the falling Rouble but I wonder is that going to encourage Russians to invest in Cyprus to safeguard against further falls or are they losing their buying power now?

The Euro fall must be helping Cyprus in this regard. I would be surprised if there wasn’t a surge in Famagusta region sales due to the latest Marina developments. Wherever the casino is chosen to be built should get a a huge boost too. If I was building it I’d build it in Larnaca right next to my plot.

I am looking forward to seeing the sales stats for domestic and foreign buyers.

@Mike G on 2015/02/08 at 2:49 pm – I have a couple of Russian friends (business strategists) and I was speaking with them on Wednesday about likely development re Russia. In their opinion speculators are causing the fluctuations in the Rouble and the country will settle down later this year. The sanctions are encouraging local production of food, etc. which is good for the domestic market, but the sanctions are starting to hit the man in the street.

(I’ve just checked again – the foreign sales statistics haven’t been published yet)

So prices are still going down but sales are up by over 10% and 90% in Larnaca and Limassol which I hear is due to the EU residence market where an investor has to invest I think over €300K.

Seemingly that market of Arabs, Russians and Chinese are buying good quality properties at not so heavily discounted prices. Even 2008 levels.

Also with news of the marina investment in Ayia Napa by the Egyptian billionaire should we expect more sales there which might lead to higher prices.

Lots of interesting questions to ponder. So many variables, NPL’s, the Cyprus financial markets opening up to overseas companies,oversupply, oil/gas, wars and extreme instability in the surrounding area,title deed fraud.It really is a game of chess. Or poker.

@Mike G on 2015/02/05 at 1:17 pm – If I had a crystal ball that could predict the future accurately, I’d be a billionaire. Other things to throw into the melting pot are the fall in value of the Rouble, the fall in the value of the Euro against other currencies, and no doubt several other factors.

I have the figures for sales contracts in January 2015 – sales are up in Larnaca & Limassol, but down in Nicosia, Famagusta and Paphos. I’m still waiting for the ‘foreign sales’ statistics to be published. Hopefully we’ll have them by the end of the week.

So the IPT prices will be less next year, right?

Ho I forgot the Government says…

“IPT doesn’t necessarily represent the price of the property”.

So one has to ask what does the IPT represent? And why is mine twice the price of the house next door, owned by a GC when their house footprint is actually bigger than mine?

@Peter Davis on 2015/02/05 at 8:09 am – Have you done about this discrepancy? You should advise the Land Registry and they will look into the matter. The Interior Minister has admitted that many mistakes were made during the recent revaluations.

The tax valuation does not represent the property’s market value – the same as the UK’s tax valuation that is used to assess Council Tax does not represent a property’s commercial value.