Those whose IPT liability is €25 or less will be exempted and those paying early will be receive a discount of 10 per cent.

At the same time the municipal property tax will be abolished and the government will compensate local authorities for the loss in revenue.

As the basis on which IPT is calculated has not been revised for 35 years, some people will receive IPT demands much higher than in previous years. One person commenting on yesterday’s article Tax incentives target rich foreigners has land whose taxable value has been revised from €14,000 in 1980 to €270,000 in 2013 and is facing a tax bill more than 200 per cent higher than last year.

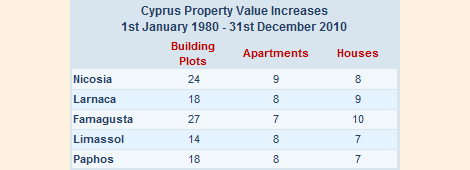

Between January 1980 and December 2010, property values rose considerably:

Appealing the Land Registry valuation

Those wishing to appeal the Land Registry valuation have until the end of 2015 to do so by phoning the Land Registry help line on 77777730 and following the instructions.

You will need to have your passport and details of the property handy. The Land Registry officer will check if there has been a mistake in the valuation while you wait.

If they say there is nothing wrong and you then decide to object to the valuation you may file your objection on the relevant form, which you or your representative must submit to the District Land Office in which the property is located with the appropriate fee based on the 2013 valuation of their property:

- For properties valued up to €100,000, the fee is €37.50.

- For properties valued between €100,001 and €500,000 the fee is €75.00.

- For properties valued between €500,001 and €1 million, the fee is €150.00.

- For properties valued in excess of €1 million, the fee is €357.00.

(Note that you will need Adobe Acrobat to read the relevant form and to display an approximate English translation of each field, float your mouse over the yellow speech bubbles.)

Finding a property’s revised taxable value

Those wishing to find a property’s revised taxable value should follow my guide at Cyprus property valuations now online.

Registering with the Tax Office

Both residents and non-residents who own or who have taken delivery of a property in Cyprus need to register with the Tax Office and should refer to my article Paying Immovable Property Tax 2014, which contains a guide on how to register together with the relevant forms.

We live in the UK and have a house in Cyprus so registered last year and paid the IPT. Will we receive a bill for IPT this year by email? UK Address? Cyprus Address? or do we have to access a portal to find out how much we pay this year?

thanks

@Jayne on 2015/07/07 at 6:58 pm – You should receive an IPT Notice by post and it will be delivered to the address you gave as your home address in question 20 on the form.

(I know that, even though their home is in the UK, some people put their home address as the address of their property in Cyprus.)

Once we went with the yellow slip the process was very quick and got our TIC number there and then.

Then downstairs to register the property with at the IPT desk, as it’s 1980 value was only 1336 Euro (and split between my wife and I, 668 Euro each) the lady at the IPT desk thought it quite funny that we were even bothering to register as the law has not even been passed yet. Anyway we got a nice statement to say at present we don’t owe anything and if the law does change they will automatically send us a bill if needed.

If you register at the Limassol tax office they also need to see your yellow slip (if you have one) as well as copy of your passport and duly completed form, go to the 2nd floor room 8 for registration and to get a TIC number. Think there are some more steps after this but guess will find out tomorrow.

We have an apartment near Larnaca which we visit maybe 3 or 4 times a year. I pay my local taxes promptly by direct debit. Am I wrong to wait for an immovable property tax bill to be posted/sent to me? When I get it, I will pay it. If not contacted, shall I just wait?

@Chris Hiscock on 2015/07/06 at 9:04 pm – Providing you have registered with the Larnaca Tax Office and notified them of the property, you will receive an IPT notice at your home address.

So many taxes its unreal, will be a real relief if they all get consolidated…although I am sure there will be cries of woe if the bill is to include the ipt, refuse collection, communal charges etc and just like with road tax and many other taxes the so called deadline will be always be extended to make your payment….’my’ local community council even had the cheek to charge a hefty rental tax! even though the home was only used as a holiday home!

Hello Nigel.

The issue of municipal tax is interesting and I wonder if there is confirmation on what continues municipal tax. In my case I pay a local community (not municipal) tax for services provided and pay a separate refuse collection tax. There is also a small annual local area improvement tax we pay.

If the bill is passed and this covers 2015, does that mean local communities will not be able to send separate bills this year as they will be compensated by the government for 2015?

Finally, will there be an early payment discount. This would then benefit the cost of municipal charges?

Thanks

@CP on 2015/07/06 at 2:02 pm – Like you, I pay a property tax to my Erimi Community rather than a Municipality. We’ll have to wait and see what the bill actually says once it’s been passed into law and has been published on cylaw.

Good morning Nigel, I am registered with the tax office, paid IPT a couple of years ago on my land, IPT was refunded due to revisions on IPT, Last November I received my updated title deed which included my house. Will the LR have informed the tax office of my new deed (which includes 2013 property value) or do I need to Go to the tax office and fill out new forms?

@Kate on 2015/07/06 at 9:57 am – There is no need for you to do anything. The Tax Office will get the information it requires to issue your IPT notice from the Land Registry.

@Nigel

“IPT is not based on the property’s market value, it is based on its taxation value as assessed by the Land Registry.”

Out of curiosity is this same system of taxation imposed anywhere else?

@houlou on 2015/07/04 at 7:42 pm – I suggest you do a Google Search on real estate taxation value

IPT- what happens for someone with no deeds

e.g took ‘ownership’ of property 10 years ago plot its built on is still developers as no deeds yet exist for home….is the IPT back dated to 2005 to include the value of the home? or is the IPT imposed on the 2013 valuations of such cases as assessed by land reg, and IPT applicable to 2013 and 2014?

@houlou on 2015/07/04 at 7:35 pm – Until 2014 it was the registered owner of the property who was liable for IPT. Any obligation on you to reimburse the registered owner will be written in your contract of sale.

Last year the law changed requiring any person who had purchased property before 1/1/2014 and had taken delivery to pay IPT. The law was not retrospective.

Hello, can I ask does IPT apply to land only or does there need to be a building on it?

Its value in 1980 was 1336 euro so no tax due and now on checking website gets a LR 2013 value of 142,000 euro, so do I need to pay IPT and register with the tax authorities, the plot is still undeveloped without any buildings?

@Graham on 2015/07/04 at 12:55 pm – All immovable property (which includes land) is subject to Immovable Property Tax. Assuming the bills are passed by MPs without any changes, you’ll be asked to pay €142. You should register with the Tax Office.

Nigel – I paid for a property on a site which contained 6 other properties. None of us have accepted the properties as they are incomplete and there is no infrastructure in place. Road, retaining walls, drainage etc. The builder has gone and the company is in liquidation. Is IPT due to be paid on these properties. We had a valuation carried out on the site last year and each of the properties came back as worthless.

@Steve R on 2015/07/04 at 7:43 am – As I advised houlou yesterday, IPT is not based on the property’s market value, it is based on its taxation value as assessed by the Land Registry.

Visited land reg today, and also received a reply from a reputable law firm, yup alas buyers have to pay, with regards to land registry reply on trapped buyers they suggest a wait and see approach as to whether changes in law will vindicate the people, and there are many I have been told that are affected …got no problem paying taxes but obviously where they are due …have no reply from any other MP or Demetra Plati regarding the proposed law….

I registered with the tax office last year, does this mean I should receive my bill in the post this year?

@Gail Burton on 2015/07/03 at 12:42 pm – Yes. You should receive an IPT notice in the post this year. It will be sent to the home address you entered against question 22 on the Form I.R.163A (2014).

Nigel, thanks, scanned over the form and it says owner fills in details (so for buyers they still complete?) , for arguments sake lets say in the eyes of the Cypriot regime, having bought a property automatically makes you the owner (that is debatable)

Scenario arises where developer failed last year to register a number of properties he has built and sold on a plot (and the buyers failed too as well!)…..between last year when he should have done so, and this year, it has transpired developer has NOT been issued a certificate of final completion….? (Properties are illegal according to some law aren’t they?)

In essence the value of the properties is zilch yes? They have no resale value do they ?they cant be sold because they are illgal?. The 2013 valuation should therefore automatically default to the price of the land only..….The system is still a joke….all stems from the useless system, no deeds no sale should be enshrined in law, at sale time ownership must be transferred with deeds, if this was the case none of this mess would have been with us today

@houlou on 2015/07/03 at 12:29 pm – Please refer to your obligations regarding Immovable Property Tax at Paying Immovable Property Tax 2014.

Also the tax is not based on the property’s market value, it is based on its taxation value as assessed by the Land Registry.

You may not agree with the law regarding your obligations – but there are many other laws that could also be considered unfair.

One of the problems is paying the tax. It seems direct debit is not an option.

@George Hatjoullis on 2015/07/03 at 10:21 am – It would also improve matters if people could pay by instalments to help them spread the cost over the year.

(I pay using JCC Smart)