These statements, which claim that “property buyers in Cyprus that bought by way of a housing loan are NOT offered title deeds whereas those that paid ‘in cash’ are finally being offered their deeds”, first appeared on an Internet forum and have been promulgated on Facebook and other social media sites.

Despite an exchange of correspondence with these people in October, they continue to promote their misguided views. Their reasons for doing this are unclear, but it appears that one of the perpetrators may be operating an unlicensed estate agency selling property in the Protaras area. This may be a ruse to drive traffic to his website.

I would like to assure everyone who has been deceived into believing that they cannot apply for their Title Deeds if they bought by way of a housing loan that:

If a purchaser wishes to apply for the Title Deeds to the property they purchased, the only requirements are that:

- their contract of sale has been deposited at the Land Registry

- they agree to deposit any outstanding financial obligations to the vendor into a suspense account set up by the Land Registry. (e.g. In their contract, some people were able to hold back a few thousand Euros until the Title Deed was available for transfer – they have to agree to deposit this money with the Land Registry.)

The fact that they have a housing loan is of no relevance.

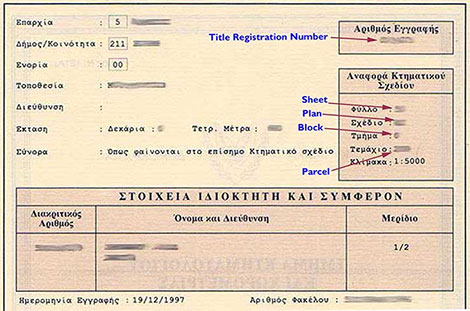

You’ll find the application form and other information in the article ‘Applying for Title deeds‘.

Thanks. Who issues the deeds and are there any impediments that could be encountered in the transfer, if as I stated in my earlier message that I intend to pay the full purchase price upfront for the developer’s property? Basically, I am thinking about buying a property but am now rather wary after reading about all the problems being experienced by past buyers in obtaining their title deeds! In South Africa, title deeds are issued within 3-4 months once the sale has been approved and gone through, irrespective of who is selling the property – a clear cut process.

(Editor’s comment: When you buy a property here it is essential that you or your independent lawyer gets Title search to establish if there are any impediments that would prevent you getting title – see New title search procedures in Cyprus.

If there is a mortgage on the property, a law that was introduced in 2011 enables you to pay the balance of the mortgage to the bank in exchange for a ‘waiver’ and the balance of the sale price to the vendor.

Let’s say that the agreed sale price is €250,000 and the balance of the mortgage of €50,000 – you pay €50,000 to the lending bank and €200,000 to the vendor.)

Interesting article and comments. Am I right in my understanding that if one buys a property through a developer and pays the full price of the property upfront, one can apply for the title deeds without experiencing any of the numerous problems mentioned in other articles?

(Editor’s comment: Yes – but of course the deed cannot be transferred until it has been issued.)

“they agree to deposit any outstanding financial obligations to the vendor into a suspense account set up by the Land Registry. (e.g. In their contract, some people were able to hold back a few thousand Euros until the Title Deed was available for transfer – they have to agree to deposit this money with the Land Registry.)”

This is a payment that was promised to the developer? Why is the land registry expecting this money to be deposited with them?

Our own development was never completed by the developer. As residents, we agreed via a lawyer to deposit this money into a joint account with the aim of completing our development together. How will the land registry view this arrangement do you think?

(Editors comment: In answer to your first questions – yes this is money that the purchaser is obliged to pay the developer according to their contract of sale. As the developer will take no part in the transfer, the Land Registry will ensure that he receives the money owed.

Regarding your last question, I cannot speak for the Land Registry, but I would have thought that they would accept the arrangement agreed with your lawyer.)

I agree with Jane. I would like to have them hung drawn and quartered.

We had a loan to buy our property but payed it up in full after 3 years of buying the property. It’s now been 8 years. So it’s been 5 years since we had the loan. Does this apply to us as well.

(Editor’s comment: Anyone, including you, can apply for their Title Deeds providing you meet the two criteria listed in the article, i.e:

1.their contract of sale has been deposited at the Land Registry

2. they agree to deposit any outstanding financial obligations to the vendor into a suspense account set up by the Land Registry. (e.g. In their contract, some people were able to hold back a few thousand Euros until the Title Deed was available for transfer – they have to agree to deposit this money with the Land Registry.)

My wife and I bought an apartment in 2007 with a Swiss franc loan unfortunately. Following your advice we applied for our deeds a few weeks ago. I got all the receipts confirming payment from the bank. Do you know how long it will take?

(Editor’s comment: I can’t say how long your deeds will take – the Land Registry has more than 4,000 and I expect it will take them some months to process.

One thing you need to bear in mind – if you with one of the groups acting on behalf of those who were mis-sold Swiss Franc loans, you must NOT carry out the transfer until the matter has been resolved by the courts.

If you carry out the transfer before the matter has been resolved, you are effectively agreeing to the loan. This is because the bank will convert your ‘home loan’ to a mortgage and lodge it as a claim against the title once the property is registered in your names – and the Land Registry will charge you 1% of the sum advanced under the loan (not the outstanding balance). By carrying out the transfer you are agreeing the terms of the CHF loan the bank granted you in 2007.

If you are not claiming that the CHF loan was mis-sold – if possible you should repay the balance of the loan to the bank. To be on the safe side you should do this after the Title Deed has been issued and before the transfer takes place. This will save you paying the Land Registry’s 1% charge.)

Thank you Nigel

These people are sick and I hope they rot in hell!

My neighbour has been waiting for her deeds for 12 years and was in tears when she read that she couldn’t apply for them because she had a loan.

Do you have there names she may wish to report them to the police and sue them.

(Editor’s comment: Yes – I do have the name of one person involved in this deceit. I’ll send you his name and what details I have by email.)