THE REVELATION that it would take ten years for Cyprus to address the Title Deed backlog was highlighted in the spring 2017 European Commission’s Post-Programme Surveillance report following the island’s exit from its Economic Adjustment Programme

THE REVELATION that it would take ten years for Cyprus to address the Title Deed backlog was highlighted in the spring 2017 European Commission’s Post-Programme Surveillance report following the island’s exit from its Economic Adjustment Programme

The report contains the finding of the mission of European Commission staff to Cyprus, which took place in Cyprus from 27 to 31 March. The key findings regarding Title Deed issuance and transfers are as follows:

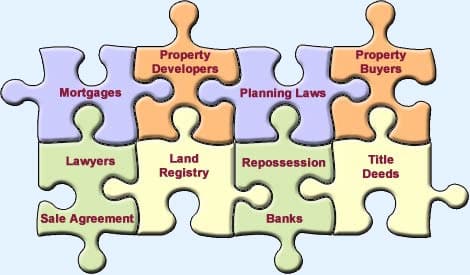

The reform of the system of Title Deeds transfers remains constrained by lack of support from private stakeholders. A substantial number of property buyers, despite having paid the full purchase price, still have not yet received their Title Deed.

The adoption of the legacy cases law (for property sales up to end of 2014) created some momentum. Out of the 13,642 applications received as of end March 2017 linked to legacy cases, nearly 5,700 Title Deeds were issued which led to approximately 2,000 transfers of titles. This is positive progress, thanks to supportive efforts by the Department of Land and Surveys, including website information, training, and an instruction manual sent to all relevant staff.

However, following numerous legal actions taken by banks against the transfer of titles, a court ruled in May 2017 that the legacy law is unconstitutional. Pending a possible appeals court decision, the application of the law is now uncertain, which calls for the design of a stable and implementable solution.

Substantial efforts are necessary to engage stakeholders to agree on a new system for the transfer of future Title Deeds. There is general agreement that a future system should ensure that buyers who pay the full purchase price will get their titles quickly and have no possibility to refuse them (for example to avoid paying overdue taxes).

The Ministry of Finance continues to examine proposals, but with little apparent progress in recent months, in part due to the political sensitivity of this issue.

There is still considerable work to be done to address the backlog of issuance of new Title Deeds. At the current rate of Title Deeds issuance, it would take approximately ten years to address the backlog of unissued Title Deeds (about 30,000 titles were pending as of March 2017).

However, the Ministry of Interior is making progress towards the streamlining of issuance procedures, notably through technical assistance by the Commission. Measures were also taken to assist the issuance and, thus, the transfer of Title Deeds where relatively minor breeches of planning conditions have occurred.

The main bottleneck preventing a faster issuance of Title Deeds appears to be the local government’s low capacity to face their obligations, notably regarding the issuance of certificates of approval. This problem might be solved through the proposed reform of local governments, but more immediate action appears warranted.

Re bottlenecks, they are a bunch of jokers, the land registry lot have go it in for the district admin lot, even internally in both places there is internal strife between say the AKEL lot and those of say DISY. If you ask me how I know, I will just say that a personal situation of mine I was legitimately chasing up I was advised to back off and not stir the waters, it was just a case of the usual siga siga mentality until my issue was resolved……not good at all to say the least.

Ed this property was not off plan but already built we were 1st time buyers.

Ed: Although the property may have already been built when you purchased, the bank could not grant you a mortgage until it’s Title Deed had been issued.

Even if you had purchased a property that already had it’s all-important Title Deed and the bank had granted you a mortgage, the Land Registry would still have charged you 1% of the sum advanced to register it as a claim against the property.

@Aggis – Indeed, I wonder why there are people still buying houses without the deeds (especially, since the title deeds issue has been more than well documented in the local and British press, and in social media)

Deeds ready, but have a small mortgage on property. Was told there would be a charge at the bank for the transfer, which I was told is a % of the remaining mortgage in our case £700 this is a government charge not the bank, this is on top of the fees to land registry.

No wonder people don’t pick up their deeds especially if they have large mortgages.

Do you know anything about this charge as surely this should be explained by the bank when a mortgage is taken out.

Ed: When you buy a property off-plan with the aid of a loan, the bank will grant you a ‘home loan’ NOT a mortgage.

A mortgage is a special kind of loan that uses the property being purchased as collateral, but as the property does not physically exist when you purchase off-plan, you cannot obtain a mortgage.

When the Title Deeds are transferred to your name, the property exists. At this time the bank converts your ‘home loan’ to a mortgage and registers it as a claim (debt) against your property.

The Land registry charges the mortgagor (i.e. you) 1% of the amount advanced under the mortgage to register it as a claim against the property.

I’m surprised (or perhaps not) that your lawyer didn’t advise you of this charge?

If possible you should repay the balance of your home loan before the transfer takes place to avoid paying this 1%.

The simplest method to adopt as a buyer is very easy “No Title Walk Away”

Then we will see how quick things will change.

Well it’s beginning to look as if my Deeds won’t be issued in my lifetime……

Ed: Some residents in Pegeia have been waiting for their deeds since 1968!

As the Ed. says: “the Troika has little (if any) influence over Cyprus now the country has exited its Economic Adjustment Programme etc. etc.”.

On the other hand, when the troika is requested to return to Cyprus, as it surely will be before say end 2018 / mid 2019, in order to ‘spring’ the next bailout to Cyprus it may well be reviewing the incomplete previous programme. Or will the troika simply follow it’s routine in Greece and gullibly fund a series of bailouts?

And the very large elephant is still padding around the Cypriot room.

Vested interests appear to be the main currency here.

Cyprus received their bailout funds on condition that they cleared the backlog of title deeds. Clear guidelines were set out by Troika and Cyprus agreed.

Bailout money has been received and the title deeds fiasco has now slowed back down to a snail pace. Troika don’t seem interested any more and seem reluctant to punish Cyprus.

Cyprus will, as usual do things their way and it will take as long as it takes.

Ed: Unfortunately the Troika has little (if any) influence over Cyprus now the country has exited its Economic Adjustment Programme and is in no position to inflict punishments.

Regarding the receipt of bailout funds the MoU said:

“Prior to the granting of the eighth disbursement of financial assistance the House of Representatives will adopt the legislation on solving the backlog of title deed transfers, which was submitted by the Council of Ministers in June 2015.”

That legislation was the trapped buyers law, which courts in Limassol & Paphos have ruled unconstitutional.