Property price increases have been assisted by further signs of recovery in the Cyprus economy, with a seasonally adjusted quarterly growth in GDP of 0.8% and an annual growth of 3.9%. Unemployment dropped significantly from 10.6% a year ago to 7.3% and from the record high of 17.6% in the first quarter of 2015.

The improved confidence in the Cyprus banking system and the improved availability of finance have assisted in a relatively higher transaction volume during the quarter, which further enhanced market sentiment. However, the issue of non-performing loans (NPLs) and Debt for Asset Swaps (DFAS) by most banks continue to be present in the market.

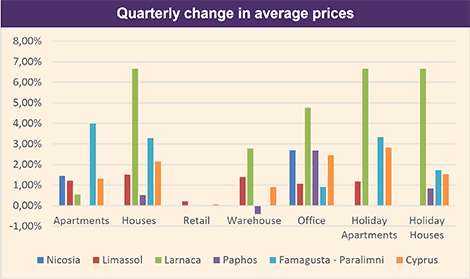

Quarterly property price changes

Compared with the first quarter of 2018, prices of residential houses and apartments rose by 1.3% and 2.1% respectively. Famagusta recorded the largest quarterly increase in apartment prices (up 4.0%), while Larnaca reported the largest quarterly rise in house prices (up 6.7%).

Residential property prices in Paphos remained stable.

Prices of holiday homes also rose over the quarter by 2.8% for apartments and 1.5% for houses. The highest increase for both holiday houses and apartments was recorded in Larnaca where each rose by 7.0%.

Annual price changes

On an annual basis apartments prices rose 7.6%, houses by 4.8%, offices by 11.6%, warehouses by 4.2% and retail by 1.7%.

Rental values

On a quarterly basis rental values increased by 2.9% for apartments, 3.9% for houses, 1.0% for retail, 1.0% for offices and 0.4% for warehouses.

On an annual basis, rents increased by 18.0% for apartments, 17.7% for houses, 3.8% for retail, 14.3% for offices and for 1.9% warehouses.

Gross rental yields

At the end of the second quarter of 2018, average gross rental yields stood at 4.5% for apartments, 2.4% for houses, 5.5% for retail, 4.2% for warehouses, and 5.1% for offices. The proportionately higher quarterly rental increases compared to quarterly price increases have marginally improved yields for apartments and offices.

The gross rental yield is a useful yardstick as to whether property is over-valued, under-valued or priced correctly. Here is a set of rules of thumb for the housing market from the Global Property Guide:

| Price/Rent Ratio |

Gross Rental Yield (%) |

|

|---|---|---|

| 5 | 20 | Very undervalued |

| 6.7 | 15 | Very undervalued |

| 8.3 | 12 | Undervalued |

| 10 | 10 | Undervalued |

| 12.5 | 8 | Borderline undervalued |

| 14.2 | 7 | Fairly priced |

| 16.7 | 6 | Fairly priced |

| 20 | 5 | Borderline overvalued |

| 25 | 4 | Overvalued |

| 33.3 | 3 | Overvalued |

| 40 | 2.5 | Very overvalued |

| 50 | 2 | Very overvalued |