Property sales in Cyprus to the overseas market continue to be hit by the COVID-19 pandemic and are unlikely to improve substantially until it becomes easier for foreigners to travel to Cyprus.

Positive news

Last month Cyprus signed agreements with Greece and Israel to ease travel restrictions allowing citizens with Covid-19 vaccination certificates to travel unimpeded between the three countries.

Just a few days ago Cyprus announced it will allow British tourists who have been fully vaccinated against Covid-19 into the country without restrictions from 1 May.

However, under the UK’s current COVID-19 restrictions, it is illegal to travel abroad for holidays or leisure purposes. But if the UK government is satisfied that its four tests are being met, the earliest date people from England will be able to travel overseas for a holiday, including Cyprus, is 17 May, when the country moves in to step three of its lockdown exit plan.

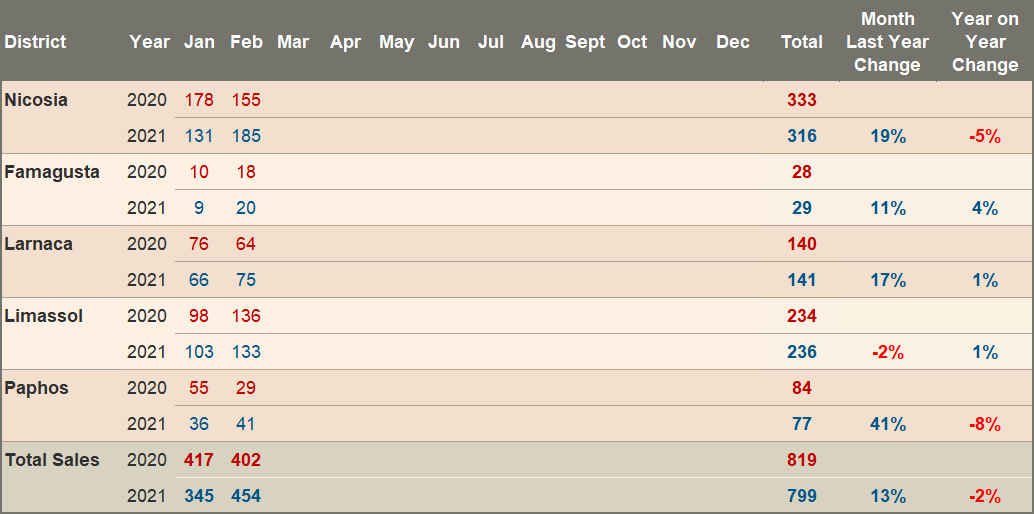

As Pavlos Loizou noted in his recent article, as Cyprus was in lockdown during the first three weeks of January, the Land Registry was understaffed, several transfers and deposits were moved to February. As you will see below, domestic sales are holding their own in the face of the pandemic.

February sales figures

During February a total of 646 property sale contracts were deposited at Land Registry offices across Cyprus. Of those 646, 70% (454) were deposited by Cypriot buyers and 30% (192) by foreigners.

EU citizens accounted for 14% (92) sales, while non-EU citizens accounted for 15% (100) sales.

Domestic property sales

In February, property sales to the domestic market performed well despite the Covid-19 restrictions, rising by 13% compared to February 2020.

Sales to EU Citizens

Property sales in February declined by 29%, mainly due to the Covid-19 restrictions imposed by their home countries and Cyprus. If efforts to contain the pandemic go well, as these restrictions ease more visitors to the island should encourage more sales.

Sales to non-EU citizens

Property sales to non-EU citizens declined 52% in February compared to February 2020. These have been hit by a double whammy; the Covid-19 restrictions and the cancellation of Cyprus’ citizenship-by-investment (aka Golden Passport) scheme last November.

A bill laying out revised criteria for citizenship has been submitted to the Cyprus parliament. According to the bill, applicants must be legally residing in the republic for the last 12 months, and for 10 years prior to their application with a total time spent on the island of not less than seven years during that period plus a number of other conditions.

Currently foreign nationals can apply for residency using the fast-track or the normal procedure.

The fast-track procedure grants permanent residence status to foreign nationals who purchase of a property sold for the first time, which is worth at least €300,000. They must also make a three-year fixed deposit of €30,000 in a Cyprus bank and must visit Cyprus to provide their biometric data and visit the country every two years.

The normal procedure grants permanent residence status to foreign nationals who have been continuously and legally resident in Cyprus for five years.

Analysis of property sales since 2000

Cyprus Property Sale Contracts 2000 – 2021

| Year | Overseas Sales | Domestic Sales | Percentage Overseas Sales |

Total Sales |

|---|---|---|---|---|

| 2000 | 450 | 12,214 | 3.6% | 12,664 |

| 2001 | 1,207 | 12,849 | 8.6% | 14,056 |

| 2002 | 2,548 | 14,111 | 15.3% | 16,659 |

| 2003 | 3,981 | 15,294 | 20.7% | 19,275 |

| 2004 | 5,384 | 11,947 | 31.1% | 17,331 |

| 2005 | 6,485 | 10,106 | 39.1% | 16,591 |

| 2006 | 8,355 | 8,598 | 49.3% | 16,953 |

| 2007 | 11,281 | 9,964 | 53.1% | 21,245 |

| 2008 | 6,636 | 8,031 | 45.2% | 14,667 |

| 2009 | 1,761 | 6,409 | 21.6% | 8,170 |

| 2010 | 2,030 | 6,568 | 23.6% | 8,598 |

| 2011 | 1,652 | 5,366 | 23.5% | 7,018 |

| 2012 | 1,476 | 4,793 | 23.5% | 6,269 |

| 2013 | 1,017 | 2,750 | 27.0% | 3,767 |

| 2014 | 1,193 | 3,334 | 26.4% | 4,527 |

| 2015 | 1,349 | 3,603 | 27.2% | 4,952 |

| 2016 |

1,813 | 5,250 | 25.7% | 7,063 |

| 2017 |

2,406 | 6,328 | 27.5% | 8,734 |

| 20181 | 4,367 | 4,875 | 47.3% | 9,242 |

| 2019 |

4,482 | 5,884 | 43.2% | 10,366 |

| 2020 |

2,985 | 4,983 | 37.5% | 7,968 |

| 2021 (Feb) |

360 | 799 | 31.1% | 1,159 |

| Totals |

73,218 | 164,056 | 30.9% | 237,274 |

1 The Department of Lands & Surveys has advised that overseas sales in 2018 and subsequent year should not be compared to sales in previous years due to changes in the methodology used to classify ‘Aliens’ (foreigners).