THE House Legal Affairs Committee’s effort to conclude two of five bills that hope to put an end to the title deeds nightmare in the property market has been delayed by a number of questions raised during recent discussions.

One such point of dispute is how to make it a criminal offence for a property seller to mortgage a property he or she has already sold as it will be obligatory to present the property’s sales contract to the Land Registry Department before any such transaction can take place.

A new meeting has been scheduled for next week, said Committee Chairman, DISY’s Ionas Nicolaou, after Monday’s session.

Nicolaou said the effort was to find a balance between the rights of the seller and the buyer, as determined in the sales contract that was signed.

This, he said, would resolve all the problems that have led to the crisis in Cyprus’ property market over the past few years.

“One matter that arises is the ability, within a period of six months from when this legislation comes into effect, to submit all sales contracts to the Land Registry, which haven’t yet been submitted,” Nicolaou explained. He added that this was independent of when the contract was signed.

But most importantly, he added, this would lead to “the creation of criminal responsibility in the event that a property seller takes out a mortgage on the property, without first confirming if the sales contract he signed was submitted to the Land Registry before applying for the mortgage”.

This measure, said Nicolaou, would protect buyers from property sellers who may sign a sales contract one day, then go and mortgage the property the following day, resulting in the mortgage having superiority over the sales contract.

Next week’s meeting is expected to shed some light on a number of issues.

The current system has left hundreds of overseas property investors at the mercy of developers who went out of business due to the current worldwide property and economic slump.

We have seen many actions til now but no efficient official reaction from state authorities regarding the hot issue of title deeds. Cyprus is a nice place to live but it is obvious that an effective central policy is missing. More than intentions real solutions are needed though.

We are told that the Land registry is one of the best in the world. So let them publish the facts.

1. How many homes in total have developer mortgages.

2. How many mortgages were taken out after the property was sold.

3. How many mortgages were taken out BEFORE the property was sold.

Then the figures would show how many lawyers are guilty of gross negligence.

It should not be an offence to mortgage a property already sold but simply and offence to ‘attempt’ to mortgage a property already sold which is simply common theft anyway.

This would neatly lay the blame on the banks, lawyers and civil servants who failed to spot it when it happens. The innocent party would simply seek damages against them. Let’s face it, it’s the so called professionals that are to blame in all of this anyway.

The crooked developers, plague on their houses, are only exploiting the ineffectiveness of Cyprus laws that allow low life scams such as this to take place. Oh yeah, while we’re here, let’s make a retrospective offence back to say, 1990.

All that this article and the attached comments prove, as well as previous examples and doubtless those to come, is that we live in a lawless, pariah state.

Shame on Cyprus. Come the time when the EU decides to do something meaningful and effective about the blatant corruption instead of mouthing platitudes of nothingness. With their appeasement, they’re in effect condoning such behaviour. Shame on the EU too…

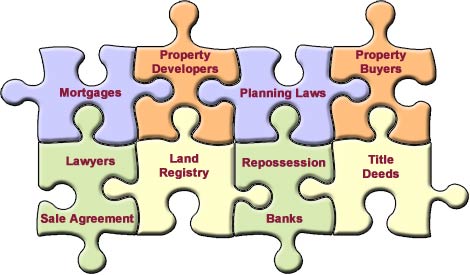

I detect an inaccuracy in the jigsaw graphic which leads this article. The jigsaw piece which represents the ‘Property Buyers’ clearly has three cavities: yet one of them is vacant.

Surely the graphic should be re-designed to show the ‘Property Developers’, ‘Banks’ and ‘Lawyers’ to have invaded the ‘Property Buyers’ cavities: just as they have in real life.

Most of the ideas suggested below don’t take into account existing buyers’ problems.

I don’t know, but I imagine double-selling constitutes a very small proportion of the problems compared to say, developers mortgaging after the sale (put me right if I’m wrong on this).

In which case, a mortgage dated AFTER the sale MUST be treated as void, the bank loses any power over the mortgaged land and it needs to take any recourse against the developer.

Where such a developer mortgage is dated BEFORE the sale date then the buyer would have to take legal action against the lawyer for not protecting the buyer’s interests.

As most of the government seems to be made up of lawyers, what do you think are the chances of this coming to any sort of logical conclusion? Me too.

So how about some ideas on the other side of the swindle? The Attorney General’s Office has decreed that Fraud and its close relative, misrepresentation, are civil crimes in the Republic of Cyprus, which means that any buyer has to take the risk that the property in question has already -or will be- sold to someone else. When developers do this they don’t need mortgages and most of the buyers cannot afford the legal fees to pursue the case in the courts. Those contemplating court action should take a look at http://www.lyingbuilder.com

Some of the ideas expressed here today would make this fraud easier to accomplish. How about creating a department that registers every purchase of property and must issue a clearance certificate for every change of ownership. We could call it the Deeds Registry.

Buyer’s solicitor includes a statement of unfettered title or otherwise to the sales contract and the date on the sales contract takes precedence over any other encumbrance lodged after that date. It’s that simple to achieve.

I don’t understand the problem?

If I sell my car in the morning to one person but still have a spare key what is wrong with me selling it in the afternoon to someone else? That’s not illegal that’s good business sense. Why can’t I do this? After all I still have a key to the car?

No one told me it is wrong, I didn’t know it was wrong, you can’t prove its wrong and I’m to stupid to understand its wrong. (and I go to church on Sunday)

So why can’t I do this with someone’s home?

They call me, (with more bends than a paper-clip) “Slightly bent”. But ‘them’ don’t understand how I do business…simples

Let’s reinvent the wheel.

How about a property is only sold when it is free and clear of any mortgages?

If there is, at closing the mortgage is paid off and the deed is transferred to the buyer.

Just leave it to the politicians and they will screw it up. After all, if they get it right the first time they will run out of work.

This fiasco will drag on for many many years. Just like the North & South divide.

People in power with too much to lose, will never make this work…..because they don’t want it fixed !

One week we say this, the next we say that..blah blah blah….and so on.

The 1000’s of people that have been stitched up by the Cypriot system, will have to live with it financially.

….on the other hand, if you can’t cope financially, throw in the keys and walk away.

When you owe the bank £1, it’s your problem.

When you owe the bank £100,000, it’s their problem!

Look into Individual Voluntary Arrangement (IVA)

If the Cypriot property system allowed the conveyancing solicitor/lawyer to issue a legal Title Deed to the individual property purchaser at the same time as the sales contract was signed and all monies were paid over then there would be no need for all of this complicated legal cr*p.