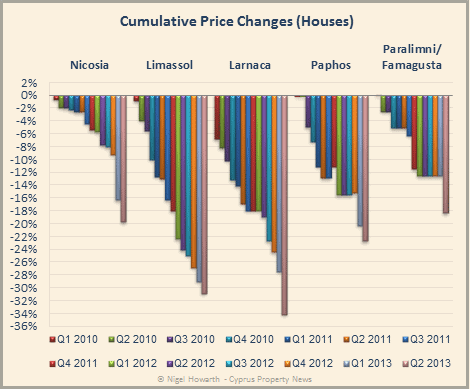

SINCE the introduction of the RICS Cyprus Property Price Index in the fourth quarter of 2009, there have been some dramatic falls in prices across the island.

Nationwide, the average price of a 2-bedroom 85sqm residential apartment of medium quality has fallen by 33.6%, while the average price of a 3-bedroom 250sqm house with a garden has fallen by 25.1%.

As we reported on Wednesday, the fall in property prices across the island accelerated during the second quarter of 2013 as a consequence of the decisions taken by the Eurogroup.

However, price falls vary considerably in different parts of the island as can be seen in the charts and tables below.

Residential apartment prices

|

Town/District

|

Residential apartment prices at Q4 2009

|

Residential apartment prices at Q2 2013

|

Percentage Change

|

|---|---|---|---|

| Nicosia | €171,155 | €128,220 | -25.1% |

| Limassol | €177,978 | €118,799 | -33.3% |

| Larnaca | €187,590 | €122,818 | -34.5% |

| Paphos | €154,917 | €101,822 | -34.3% |

| Paralimni/Famagusta | €153,790 | €89,942 | -41.5% |

| Average price | €169,086 | €112,318 | -33.6% |

Residential house prices

|

Town/District

|

Residential house prices at Q4 2009

|

Residential house prices at Q2 2013

|

Percentage Change

|

|---|---|---|---|

| Nicosia | €523,438 | €420,271 | -19.7% |

| Limassol | €496,250 | €343,181 | -30.8% |

| Larnaca | €438,750 | €289,220 | -34.1% |

| Paphos | €460,417 | €356,087 | -22.7% |

| Paralimni/Famagusta | €412,500 | €336,867 | -18.3% |

| Average price | €466,271 | €349,125 | -25.1% |

Please note that the RICS index does not include the prices of holiday homes.

Hi all,

This is all very confusing. If we do want to buy, what are the realistic prices? What is the guideline and what to look out for.

Hope to get some help here and maybe more realistic insight. Thank you

Anyone who thinks a 2-bedroom 85sqm residential apartment especially in Larnaca could command €122,818 is living in cloud cuckoo land and until the prices reflect the demand (almost non existent) normality will not prevail.

@Mike – We will (hopefully) have a broader index of property prices in the second quarter of next year when the government starts producing a property price index (as required by the troika) that will:

“vary according to location and zoning as well as other building- and plot-related characteristics”.

There are a couple of issues with statistics based on actual selling/transfer prices:

1. There are so few sales and transfers taking place that prices would vary widely.

2. You’d need to take into account the size and other factors such as quality that are not available.

As for holiday homes, anecdotal evidence suggests that prices have fallen more than those of residential properties.

These figures are still unrealistic in my view and possibly kept high by design by interested parties.

I see that a 3 bed apartment at the twin towers in Limassol is marketed at €1,650,000. Some idiot may pay it but it would be nice to have statistics based on actual selling/transfer prices. Cyprus neither has the infrastructure or manicured environment to command Mayfair prices although Aphrodite Hills and the new Limassol Marina hopefully will be the exception to the rule.

As most, not all, readers of property news in a newspaper written in English will be holiday home owners it may be nice to have figures for or which include holiday homes. I fear then the scale of reduction would be far greater than is indicated by the figures produced.

This additional data gives a much broader insight into what’s been happening to property values on the island. We can only wait and watch to see what the Cyprus Panel shows at the end of Q3 but given the severity of the economic and banking problems only now being tackled I can only see this showing further dramatic falls.

I pity anyone who really has to sell a property under these conditions – which will probably further worsen when the proposed Bad Bank starts to flog off many 1,000s of properties and plots at distress/bargain basement prices.

Then there’s the proposed Hike in IPT which will only add to the burdens of property ownership in this country.

All this said Cyprus is for us a great place to live, we never bought our residence here as an Investment, it’s still worth a fair bit more than we paid for it in 2006, we got our Title Deed within 8 weeks of Completion – and thankfully we have no need or desire to sell it. So in terms of timing and lifestyle considerations we are certainly among the Lucky ones!