ACCORDING to Land Registry figures published today, the number of property contracts deposited at Land Registries throughout Cyprus in June was 589 compared with the 864 deposited in the same period last year; a fall of almost 19% and the biggest monthly drop for more than two years.

During the first half of 2011, property sales have fallen 20% to 3,577 from the 4,408 sold during the first half of 2010.

But even more worrying for the real estate industry is the fact that property sales in 2011 are worse than those of 2008; the year the market crashed, when just 3,848 properties were sold in the first half of the year.

During June, sales fell in all areas. Worst hit was Larnaca, where sales tumbled 46% compared with June last year. Larnaca was followed by Paphos (-41%), Famagusta (-39%), Nicosia (-34%) and Limassol (-7%).

Property valuer Polys Kourousides said that "prices must be cut to increase sales" and last week the Cyprus Land & Building Developers' Association proposed a series of measures that the government should take to help stimulate the property industry.

The banks have tightened their lending criteria making home loans (mortgages) more difficult to obtain and high interest rates must also be a contributory factor in the drop in sales along with the general unease about the state of the Island's economy.

Overseas sales

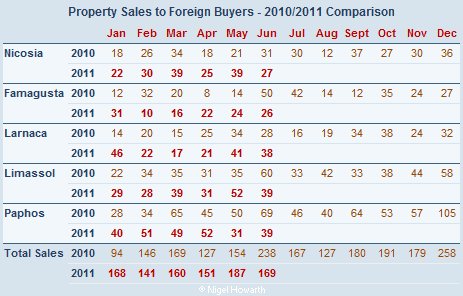

Property sales to foreign buyers also fell in June with a total of 169 contacts in favour of foreigners being deposited compared with 238 in June 2010; a fall of 29%.

Although property sales in Larnaca were up 36%, they fell in all other areas. In Famagusta, sales plunged 48% compared with June last year. Famagusta was followed by Paphos (-44%), Limassol (-35%) and Nicosia (-13%).

Although tourist arrivals are up by 11% this year and revenue attributed to tourism is up by more than 19%, it seems that few tourists are showing an interest in buying property.

As a home owner I can accept that other economic factors have affected Cyprus in addition to the title deed and developer mortgage scams.

However having bought my property outright I would like the choice of being able to sell at a time of my choosing even if it is at a substantial discount. I cannot.

Others find themselves in the position of having to sell for whatever reason but cannot.

Many speak of simply buying a resale. My house would be a resale but it still has no title and an unpaid developers mortgage on it.

When the markets pick up Cyprus will not as the Government has done nothing to put an end to this fraud. In this poor market anyone with an ounce of common sense would use the time to sort the fundamental problem of developer mortgages and give buyers the confidence to invest. But no. Here they just try and pass the buck to existing home owners and think up new money making schemes such as getting your titles for a fee.

Property sales and prices have certainly fallen and problems with Title Deeds and lack of mortgages are certainly a factor – but the main problem is the UK economy. Most of the sales at the peak were to English people who were confident in their lifestyle, had spare money and looking for a holiday home in the sun. This confidence has now gone and everybody worried about their jobs and future – nothing to do with Cyprus! The bulk of current sales are to people looking to retire out to Cyprus, not holiday homes.

Where is UTOPIA? A number of people on this forum are hoping that the property market will totally collapse and that all English people will leave the island – but where will they all go? Presumably people who are thinking like this, left England because they were unhappy there as well. A short time ago many were buying in Morocco and Egypt – not a good choice. Maybe Bulgaria where property is cheap – but the home of property scams and prices collapsing much more than here. Spain, a popular choice but prices and sales are down more than Cyprus – and if a serious building irregularity – they do not delay Title Deeds – they knock the house down !!

Cyprus is certainly not perfect but given a choice I am certainly staying here – but if somebody on here can tell me where this perfect Utopia is – I may consider moving.

@mickeyBE – We published an article about Power of Attorney certification in March that included legal opinion on the matter – ‘Power of Attorney documents – certification & validity‘.

I also saw that its possibly illegal to authorise a power of attorney unless they know you personally; just meeting and signing is not enough. Which is probably the case in most of our experiences.

Any comments?

Nigel, re The Times article, are you not able to publish extracts of it or at least provide a commentary on its content?

If as you say that it appears that Alpha Bank are telling blatant lies to newspaper reporters then this should be opened up to a wider audience.

@Steve – thanks for your comments.

Friends of mine recently sold their house and bought an apartment.

Twelve Cypriot couples viewed their house and they all asked the same question “have you got the Title Deeds”. (Fortunately, he was able to say yes).

It is the fall in domestic sales that is particularly worrying – and when you consider that average monthly salaries quoted by the Cyprus Statistical Service are €2090 for men and €1712 for women, it isn’t surprising that many Cypriots cannot afford to buy a home.

Sales to non-Cypriots account for less than a third of the total market.

When I look at the sales figures I wonder if sentiment is pushing comments in a particular direction and how valid that is. Everyone is interpreting the fall in sales as a sign that the title deeds issues are responsible 100% for turning buyers away. I wonder what the sales would be if there were no title deeds issues.

For example, I saw an article on the UK housing market, trying to bolster sales on the basis that property at current prices will never be seen again once demand improves. The picture here in Cyprus is made worse by the deterioration of the Pound Sterling against the Euro, much of the fall occurring since Sept 2008. Until someone works out the effects of the individual factors aren’t we all jumping to conclusions when we write poor sales all down to title deeds and developer mortgages?

@paul – I know for a fact that people who applied for CHF mortgages did not sign declarations.

In fact some people have been sent declarations by the bank asking for them to be signed and returned.

Many mortgages were taken out by lawyers acting under Power of Attorney and many buyers had no idea they had a mortgage let alone sign declarations that they understood the risks!

(You will see that I am mentioned in the article and I have asked The Times if I can republish it).

There was an article in the Times last Saturday where Alpha Bank were quoted as saying that all people who applied for a Swiss Franc mortgage signed a declaration that stated that they were aware of the risks of this. Comments please.

The property valuer quoted above says prices must be cut; but at the same time the government intends to ‘re-value’ properties – thus making prices and transfer fees more expensive.

It’s little wonder that no-one has any confidence in the Cyprus property market!

@Andrew – you should not confuse property built for the British tourist market with property built for the (mainly local) residential market – there is a world of difference.

If you were to consider buying in Cyprus now you would check the Internet, just to see how other “investors” suggest they have managed with developers, banks, and lawyers. Oh dear, no sensible person would come near this island if they have any sense. These people and others in authority are bringing this beautiful island to it’s knees through pure greed. They have fed on the naivety of the Brits for too long now, and realised we have at last gone on hunger strike . Even tourism will suffer because of the greed, I and many other family and friends will not put another penny into their coffers, thus making them squirm like they do to us. Do not bite the hand that feeds you come to mind. Will the last Brit to leave Cyprus please turn the light off !!!!!!

Fish & Chips @ haute quisine price no less.

So they come to the conclusion that the average price for a three bed semi is €431,000 + €27,000 tax . They don`t issue Title Deeds and they wonder why no one buys any-more.

I wonder if the supply of easy mortgages is still available to any old crooked developer.

@Martyn – thanks for your comments.

In my opinion, Cyprus geared its appeal to the ‘fish & chips’ market rather than the ‘haute cuisine’ market.

It went for quantity rather than quality in its eagerness to get money.

The ‘haute cuisine’ market is still there, but whether it is prepared to buy in those parts of the island that are covered in little white concrete boxes is questionable.

There is only one way out of this and to hurt the people responsible. That is to go down with them and hopefully survive . For the greater good we must all suffer and watch them squirm. Personally I am not driven by greed so I won’t suffer as much.

The Cyprus government either doesn’t understand the seriousness regarding the Cyprus property Market, and it’s impacts on the banking and construction sectors – or it is still in Denial – despite the raft of Reports/Statistics showing the Market is rapidly losing the last remnants of it’s appeal.

Vendors, private & commercial, despite slashing prices, in some cases massively, are finding it ever more difficult to raise any interest, let alone attract potential Buyers. Rental values appear to be well down too whilst the stock of Ready-to-buy dwellings seems to continue to rise inexorably.

And as the £ continues to fall against the €, more and more Brits are no doubt going to ‘try their luck’ in an already crowded Market place, putting even more pressure on prices, underlying values.

Can ANYONE see any reasons to be cheerful?

Anyone buying in Cyprus whether north or south really hasn’t done their homework. If they had, they would look elsewhere.

Regarding the Title Deed scandal & other malpractices here in Cyprus. We are waiting for a statement from the EU Justice Commission ASAP!

The Cyprus Government know how to fix this, and still they procrastinate.

I think Polys has missed the point.

No deeds no sale.

Government efforts have not been good enough to lure buyers back to Cyprus.

Until this is resolved rather than papered over the industry will continue to free fall.